Why Virginia Riders Need the Best Motorcycle Insurance Now More Than Ever

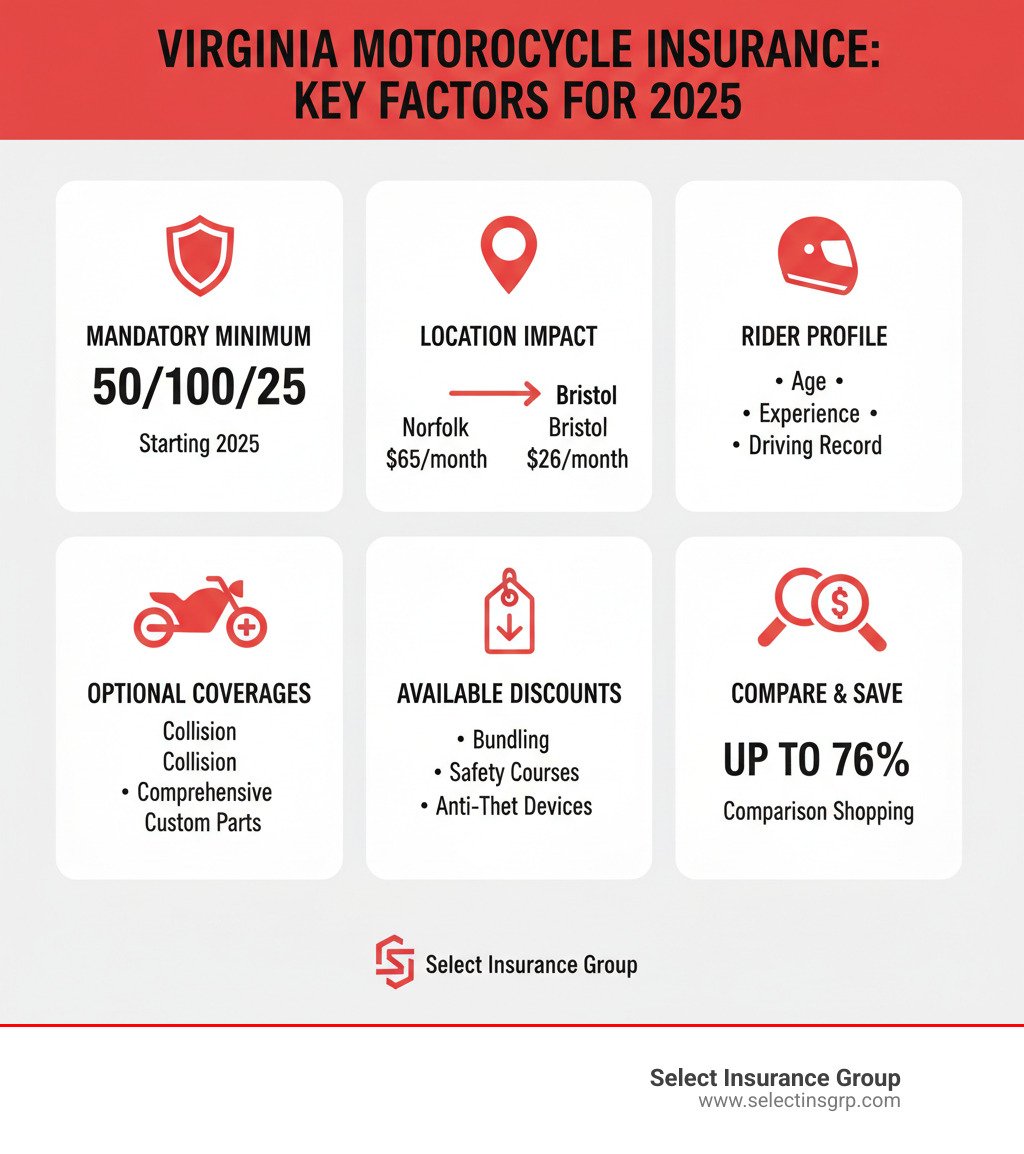

Best motorcycle insurance virginia is essential for every rider in the Commonwealth, especially with major law changes taking effect in 2025. Here’s what you need to know right now:

Quick Facts:

- Virginia eliminated the uninsured motor vehicle fee on July 1, 2024 – insurance is now mandatory for all riders

- Current minimum: 30/60/20 coverage

- New 2025 minimum (Jan 1): 50/100/25 coverage

- Average full coverage: $31/month ($366/year)

- Rates vary by city: $26/month in Bristol vs. $65/month in Norfolk

Whether you’re cruising down the Blue Ridge Parkway, navigating Richmond’s city streets, or exploring Virginia’s coastal highways, having the right insurance policy protects both your ride and your financial future. The good news? Comparison shopping can save you up to 76% on average.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, and over my three decades in the insurance industry, I’ve helped thousands of Virginia riders find the best motorcycle insurance virginia has to offer. Our agency shops over 40 carriers to find you the perfect balance of coverage and cost.

Best motorcycle insurance virginia terms simplified:

Understanding Virginia’s Motorcycle Insurance Laws and Costs

Let’s talk about something that might not be as exciting as your next ride through Shenandoah Valley, but it’s definitely important: understanding Virginia’s motorcycle insurance laws and what you’ll actually pay.

Here’s the big news if you haven’t heard: as of July 1, 2024, motorcycle insurance became mandatory in Virginia. The state eliminated the uninsured motorist fee option, which means every single bike on the road needs to be properly insured. No exceptions, no workarounds.

So what does the best motorcycle insurance virginia riders can find actually cost? On average, you’re looking at about $31 per month for full coverage, which works out to $366 per year. If you’re just going for minimum coverage, expect to pay around $27 per month. But here’s where it gets interesting—your actual rate depends heavily on where you park your bike at night.

If you’re in Norfolk, you’ll pay the highest rates in the state at around $65 per month. Meanwhile, riders in Bristol, Harrisonburg, Staunton, and Winchester enjoy the cheapest rates at about $26 per month for full coverage. That’s a difference of nearly $40 monthly, or $468 annually, just based on your zip code. Location really matters when it comes to insurance costs.

But there’s something even more important on the horizon. Virginia is raising its minimum insurance requirements, and you need to be ready.

| Coverage Type | Current Minimum (Until Dec 31, 2024) | New Minimum (Starting Jan 1, 2025) |

|---|---|---|

| Bodily Injury per Person | $30,000 | $50,000 |

| Bodily Injury per Accident | $60,000 | $100,000 |

| Property Damage | $20,000 | $25,000 |

These increases aren’t suggestions—they’re the law. If your policy doesn’t meet these new minimums come January, you’ll be riding illegally. We strongly recommend checking your coverage now, not on New Year’s Eve.

Virginia’s Minimum Motorcycle Insurance Requirements

Right now, Virginia requires what we call 30/60/20 coverage. That means your policy must include at least $30,000 for bodily injury liability per person, $60,000 for total bodily injury liability per accident, and $20,000 for property damage liability per accident.

These numbers represent the financial protection you have if you cause an accident. The bodily injury coverage pays for medical bills, lost wages, and pain and suffering for people you injure. The property damage coverage handles repairs to vehicles, buildings, fences, or anything else you might damage in a crash. You can learn more about these requirements on our minimum motorcycle insurance virginia page.

Starting January 1, 2025, those minimums jump significantly to 50/100/25. Your policy will need to provide $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $25,000 for property damage. These changes are outlined in the Virginia law changes that take effect next year.

Here’s something many riders don’t realize: Virginia also requires uninsured and underinsured motorist coverage at the same limits as your liability coverage. That means you need UM/UIM coverage at 30/60/20 now, and 50/100/25 starting in 2025. This coverage is your safety net when someone without insurance (or without enough insurance) hits you. It’s not optional—it’s mandatory, and honestly, it’s one of the most valuable coverages you can have.

Legal Requirements for Riding in Virginia

Insurance is just one piece of the legal puzzle. Virginia has several other requirements that every rider needs to follow.

First, you need the right motorcycle license classification. You can’t just hop on a bike with your regular driver’s license. You need either a motorcycle designation added to your license or a license specifically restricted to motorcycle operation. This ensures you’ve passed the proper tests and know how to handle a bike safely.

Virginia offers excellent motorcycle safety programs that can help you meet these requirements and become a better rider. The Virginia DMV provides comprehensive training courses for all skill levels. Completing these programs often qualifies you for insurance discounts too, so they’re worth your time for multiple reasons. Check out the Virginia DMV motorcycle handbook for complete details.

Virginia has a universal helmet law, which means every rider and passenger must wear a helmet—no exceptions based on age or experience. It’s non-negotiable and frankly, it’s just smart riding practice.

Finally, let’s clear up a common question: lane splitting is illegal in Virginia. Some riders see motorcycles doing this in California or other states and assume it’s okay everywhere. It’s not. In Virginia, lane splitting and lane filtering will likely get you charged with reckless driving. Stay in your lane, even when traffic is crawling.

Understanding these laws helps you ride confidently and legally throughout the Commonwealth. When you’re compliant with both insurance and safety requirements, you can focus on what really matters—enjoying the ride.

Decoding Your Coverage: What’s Included in a Virginia Policy?

Meeting Virginia’s minimum insurance requirements is legally necessary, but honestly? It’s rarely enough. I’ve seen too many riders face financial hardship after an accident because they thought the bare minimum would protect them. The truth is, motorcycle accidents carry a high cost, often resulting in more serious injuries than car accidents. When you’re shopping for the best motorcycle insurance virginia offers, understanding what’s actually in your policy makes all the difference.

Think of your policy as layers of protection, each one adding security for different situations. Liability coverage is your foundation—the legally required part that covers bodily injury and property damage you might cause to others. If you’re at fault and someone gets hurt or their property is damaged, this coverage protects your bank account from devastating lawsuits.

But what about your own bike? That’s where collision coverage comes in. This pays to repair or replace your motorcycle after a crash with another vehicle or object, regardless of who caused it. If you’re still making payments on your bike, your lender will require this coverage—and for good reason. Your bike is likely one of your most valuable possessions.

Comprehensive coverage handles all those “life happens” moments that have nothing to do with collisions. Your bike gets stolen from your driveway? Comprehensive covers it. A hailstorm dents your tank? Covered. Hit a deer on a back road? That’s comprehensive too. Fire, vandalism, floods—all the things that can damage your motorcycle when you’re not even riding it.

Mandatory Uninsured/Underinsured Motorist coverage (UM/UIM) we mentioned earlier? This is your safety net when the other driver doesn’t have enough insurance—or worse, none at all. In hit-and-run situations, this coverage becomes your lifeline. It ensures you and your passengers aren’t left holding the bill for someone else’s irresponsibility.

Medical Payments coverage (MedPay) is something I always recommend discussing with clients. It pays your medical expenses after an accident, no matter who was at fault. Those emergency room visits, ambulance rides, and follow-up treatments add up fast. MedPay helps cover deductibles, co-pays, and other immediate medical costs for you and your passengers.

Optional Coverages for Total Protection

Now let’s talk about taking your protection to the next level. These optional coverages transform a basic policy into one that truly fits your riding lifestyle.

Custom Parts & Equipment coverage (CPE) is non-negotiable if you’ve customized your ride. Spent thousands on aftermarket exhaust, custom paint, or chrome accessories? Standard policies typically include only about $3,000 for custom parts—often not nearly enough. You can increase this coverage to $10,000 or more to properly protect your investment. Without CPE coverage, you might get paid for a stock bike while your custom beauty sits in pieces.

Roadside Assistance is one of those coverages you don’t think about until you desperately need it. Dead battery at 9 PM on a country road? Flat tire fifty miles from home? This coverage typically provides up to $300 per breakdown for towing, jump-starts, gas delivery, and tire changes. For the minimal cost, the peace of mind is worth it.

If you’re a touring rider who takes long trips through Virginia’s beautiful countryside and beyond, Trip Interruption coverage can be a lifesaver. Your bike breaks down three states away from home, and you’re stuck waiting for repairs. This coverage reimburses you for hotel rooms, meals, and transportation while you’re stranded. It’s the difference between a minor inconvenience and a vacation-ruining disaster.

Total Loss Replacement is perfect for newer motorcycles. If your bike is totaled within the first year or two of ownership, this coverage pays for a brand new replacement of the same make and model—not just the depreciated value. You bought new, you get new.

Finally, Guest Passenger Liability specifically protects you if a passenger riding with you gets injured in an accident you caused. This coverage typically mirrors your general liability limits and provides an extra layer of protection for both you and your riding companions.

These optional coverages might seem like extras, but they’re really about building a complete safety net. The best motorcycle insurance virginia riders choose is the coverage that matches their actual needs, not just the legal minimums. We shop over 40 carriers to help you find that perfect balance of comprehensive protection and affordable premiums. Let’s build a policy that lets you ride with real confidence.

How to Find the Best Motorcycle Insurance in Virginia for Your Budget

Let’s talk about something every rider cares about: getting great coverage without emptying your wallet. Finding the best motorcycle insurance virginia offers isn’t just about protection—it’s about smart shopping. Here’s a truth that might surprise you: riders who take the time to compare quotes from multiple providers can save up to 76% on average. That’s real money you could spend on better gear, a weekend trip down Skyline Drive, or upgrades for your bike.

Your insurance premium isn’t pulled out of thin air. Insurers calculate your rate based on specific factors about you and your ride. Your age plays a major role—younger riders under 25 typically pay more because statistics show they’re involved in more accidents. As you gain experience and a few more birthdays under your belt, those rates naturally come down.

Experience matters too. The longer you’ve been riding and holding that motorcycle endorsement, the better your rates tend to be. Insurance companies see seasoned riders as lower risk, plain and simple. Your driving record is equally crucial. A clean record is worth its weight in gold when it comes to premiums. Tickets, at-fault accidents, or serious violations like DUIs will push your costs higher, though some riders with minor infractions can still find affordable rates.

The type of motorcycle you ride significantly impacts your premium. Sport bikes, with their high performance and appeal to thieves, cost more to insure than cruisers or touring bikes. A smaller, less powerful bike designed for efficiency? That’s typically easier on your insurance budget.

Where you live in Virginia makes a real difference too. Remember those rate variations we mentioned earlier? A rider in Bristol might pay $26 per month while someone in Norfolk pays $65 for similar coverage. Your local traffic patterns, road conditions, and even neighborhood theft rates all factor into your premium. Finally, how much you ride matters—if you’re a weekend warrior putting on limited miles, some insurers offer lower rates since you’re simply on the road less often.

Opening up Discounts for Cheaper Premiums

Here’s where things get exciting. Insurance companies genuinely want to reward safe, responsible riders. The trick is knowing which discounts to ask for and making sure you’re getting every single one you qualify for.

Bundling your policies is often the biggest money-saver. When you combine your motorcycle insurance with your auto or home insurance options, most insurers offer substantial discounts. It simplifies your life and saves you money—that’s a win-win.

Completing a safety course does more than make you a better rider. Approved courses from organizations like the Motorcycle Safety Foundation often earn you a discount that pays for the class several times over. Installing anti-theft devices like alarms or GPS trackers can reduce your comprehensive coverage costs, since you’re making your bike harder to steal.

Your good driver discount kicks in when you maintain a clean record with no accidents or violations for a set period. If you own multiple bikes, ask about the multi-bike discount—insuring them all with one company typically saves you money on each policy. Some association memberships through motorcycle clubs can open up special rates too.

Paying your premium in full rather than monthly installments usually earns a discount. Mature riders over 55 or 60 often qualify for additional savings thanks to their proven track record. Storing your bike in a secure garage reduces theft and damage risk, which many insurers reward with lower rates. And if you’re military—active duty, veteran, or family—make sure to mention it, as many providers offer exclusive discounts for service members.

We help riders at Select Insurance Group find every available discount. It’s part of finding the best motorcycle insurance virginia has to offer without overpaying.

Finding the best motorcycle insurance virginia for Your Rider Profile

No two riders are exactly alike, and your insurance should reflect your unique situation. Let’s look at how different riders can approach finding their ideal coverage.

Young riders between 16 and 25 often face the highest premiums due to limited experience. But there’s hope. Taking a safety course, keeping your record spotless, and choosing a less powerful standard bike can bring your costs down significantly. Some young riders find rates as low as $14 per month with the right approach.

Senior riders aged 65 to 80 typically enjoy some of the lowest rates available, especially with decades of riding experience and clean records. Some seniors pay as little as $7 per month for coverage. If you’re a military member or veteran, always mention your service status when getting quotes. Many providers partner with military-focused organizations to offer custom benefits and competitive rates.

Daily commuters who depend on their motorcycle for transportation might prioritize coverages like roadside assistance and rental reimbursement. Higher liability limits make sense when you’re on the road every day. These riders need protection that matches their increased exposure.

Riders with past accidents or violations face higher premiums, but affordable options still exist. Whether you have a speeding ticket, an at-fault accident, or even a DUI on your record, some insurers are more forgiving than others. Rates as low as $9 per month are possible even with a blemish on your record—you just need to know where to look.

High-risk riders with multiple accidents, severe violations, or very powerful bikes face the biggest challenges. Finding coverage requires patience and often means working with an independent agency like ours that can access dozens of carriers. We’ve helped many high-risk riders find coverage when they thought it was impossible.

No matter which category you fall into, our goal remains the same: helping you build a policy that protects you properly without straining your budget. That’s what finding the best motorcycle insurance virginia is really all about.

Frequently Asked Questions about Virginia Motorcycle Insurance

Throughout my three decades in the insurance business, I’ve answered thousands of questions from Virginia riders. Some questions come up time and time again, and I want to address them here so you can make confident, informed decisions about your coverage.

What are the new motorcycle insurance requirements in Virginia for 2025?

This is probably the question we’re hearing most frequently right now, and for good reason. Starting January 1, 2025, Virginia is making a significant change to its minimum insurance requirements. The new law requires all motorcycle policies to carry 50/100/25 coverage, which is a substantial increase from the current 30/60/20 limits.

Let me break down what those numbers mean in plain English. The first number—$50,000—is the minimum your policy must cover for bodily injury liability per person injured in an accident. The second number—$100,000—represents the total bodily injury liability coverage per accident, regardless of how many people are hurt. And that final number—$25,000—is the minimum property damage liability coverage per accident.

These increases aren’t small adjustments. We’re talking about a jump from $30,000 to $50,000 for individual injuries, and from $60,000 to $100,000 for total accident coverage. The property damage minimum rises from $20,000 to $25,000. This change reflects the rising costs of medical care and vehicle repairs, and it’s designed to ensure that everyone on Virginia roads has more adequate financial protection. If you haven’t reviewed your policy lately, now’s the time to make sure you’ll meet these new standards come January.

Is it cheaper to insure a motorcycle than a car in Virginia?

I get asked this question all the time, especially by riders who are considering buying their first bike or adding one to their garage. The short answer? Generally yes, motorcycle insurance tends to be cheaper than car insurance in Virginia.

There are several practical reasons for this price difference. First, motorcycles typically cause less property damage in accidents compared to cars. A bike simply doesn’t have the mass and weight to cause the same level of destruction to other vehicles or property. Second, motorcycles themselves are often less expensive to repair or replace than cars—though I’ll admit some of those high-end touring bikes and custom builds can rival car prices!

Perhaps the biggest factor is seasonal use. Many Virginia riders park their bikes during the colder months, meaning they’re accumulating far fewer miles annually than someone who drives a car year-round. Less time on the road translates to less exposure to risk, which insurers recognize in their pricing.

That said, individual factors still matter tremendously. Your age, riding experience, driving record, and especially the type of motorcycle you own all play significant roles. A 22-year-old on a high-performance sport bike will pay considerably more than a 45-year-old on a cruiser, even though both are riding motorcycles. The best way to know what you’ll actually pay is to get a personalized quote that takes your specific situation into account.

Do I need to keep my motorcycle insurance active during the winter?

This is a question I hear every fall, and I understand why riders ask it. If your bike’s going to sit in the garage for three or four months, why keep paying for insurance? But here’s my honest recommendation: yes, you should absolutely keep your coverage active during the winter months.

Let me explain why. First, many insurance companies reward riders who maintain continuous coverage with loyalty discounts. If you cancel your policy for the winter and then restart it in spring, you might lose those discounts and actually end up paying higher premiums when you reinstate coverage. That gap in coverage can cost you more money in the long run.

But there’s a more important reason: your motorcycle still faces risks even when it’s not being ridden. Theft doesn’t take a winter vacation—in fact, bikes in storage can be attractive targets for thieves. Without an active comprehensive policy, you’d be out of luck if someone broke into your garage and stole your ride. The same goes for fire damage, vandalism, or even damage from severe weather. I’ve seen too many heartbreaking situations where a rider’s beloved bike was damaged or destroyed during the off-season, and they had no coverage because they’d canceled their policy to save a few dollars.

The good news is that you don’t necessarily have to pay full premiums during the off-season. Some insurers offer what’s called a “lay-up” policy or seasonal adjustment options. These allow you to reduce certain coverages while maintaining essential protection against theft, fire, and other non-riding risks. We can help you explore these options to find the best motorcycle insurance virginia solution for your off-season needs—one that protects your investment without breaking your budget.

The bottom line? A little bit of year-round coverage can save you from a lot of financial heartache. It’s one of those situations where the peace of mind is absolutely worth the modest cost.

Ride with Confidence in the Commonwealth

You’ve made it through the curves and straightaways of Virginia’s motorcycle insurance landscape, and now you’re equipped with the knowledge to make smart decisions about protecting your ride. From understanding that insurance is now mandatory for all riders to preparing for the 2025 increase in minimum coverage requirements, you know what it takes to stay legal and protected on Virginia’s roads.

The reality is that finding the best motorcycle insurance virginia offers isn’t just about meeting state minimums—it’s about finding coverage that truly protects your investment and your financial future. Whether you’re cruising the Blue Ridge Parkway on weekends or commuting daily through Richmond’s streets, having adequate coverage means you can focus on the joy of riding instead of worrying about what might happen if things go wrong.

Here’s what’s most important to remember: navigating these complexities doesn’t have to be overwhelming, and you certainly don’t have to figure it all out on your own. This is exactly where the value of working with an independent agent becomes clear. At Select Insurance Group, we’ve spent over three decades learning the ins and outs of the insurance industry, and we’ve built relationships with more than 40 different carriers specifically so we can find you the perfect policy. We’re not tied to any single insurance company, which means our loyalty is entirely to you—not to a corporate headquarters somewhere.

We genuinely love helping Virginia riders find coverage that fits their unique needs and budgets. Whether you’re a young rider just getting started, a seasoned veteran with custom modifications, or somewhere in between, we have the expertise to match you with the right protection at the right price. The upcoming law changes make this an especially important time to review your coverage and make sure you’re prepared for January 1, 2025.

Don’t leave your protection to chance or wait until the last minute to adjust your policy. Get your personalized Virginia motorcycle insurance quote today and find how much you could save while ensuring you have the peace of mind to enjoy every twist, turn, and open stretch of road that the Commonwealth has to offer. We’re here to help you ride with confidence, knowing you’re properly protected no matter where your journey takes you.