Why Asheville Drivers Need the Right Auto Insurance

Car insurance Asheville NC is essential for protecting yourself on some of the most beautiful—and challenging—roads in North Carolina. Here’s a quick overview for Asheville drivers:

- Minimum Required Coverage: $30,000 bodily injury per person / $60,000 per accident / $25,000 property damage

- Average Monthly Cost: $28 for minimum liability, $95 for full coverage

- Uninsured/Underinsured Motorist Coverage: Mandatory in North Carolina

- Penalties for Driving Uninsured: $50-$150 fines, license suspension, reinstatement fees

Living in Asheville means navigating winding mountain roads, steep grades, and unpredictable winter weather. These unique driving conditions make proper auto insurance more than just a legal requirement—it’s a financial safety net. With approximately 11% of major roadways in poor condition and 61% of bridges requiring maintenance, Asheville drivers face risks that go beyond typical city driving.

Understanding your coverage options can save you money while ensuring you’re protected. Finding the right balance between cost and coverage is crucial for every driver in the area.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, I’ve helped drivers across the Southeast—including Asheville—find affordable, comprehensive Car insurance Asheville NC solutions. My team specializes in shopping across more than 20 carriers to deliver competitive rates and personalized service for mountain-area drivers.

Car insurance Asheville NC terminology:

- NC auto insurance requirements

- NC auto insurance companies

- where in north carolina is auto insurance the least expensive

Understanding North Carolina’s Auto Insurance Laws

North Carolina operates as an “at-fault” state for car accidents, meaning if you cause an accident, you are financially responsible for the damages. State law requires drivers to carry specific coverages to handle these costs.

- Bodily Injury Liability (BI): Pays for medical expenses and lost wages for others if you cause an accident that injures them.

- Property Damage Liability (PD): Covers repairs to another person’s property, like their car or a fence.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if you’re hit by a driver with no insurance or not enough to cover your damages. With about 10.3% of NC drivers uninsured, this coverage is critical.

Understanding these requirements is key to being legally compliant and financially protected. For more details, see our guide on North Carolina Auto Insurance.

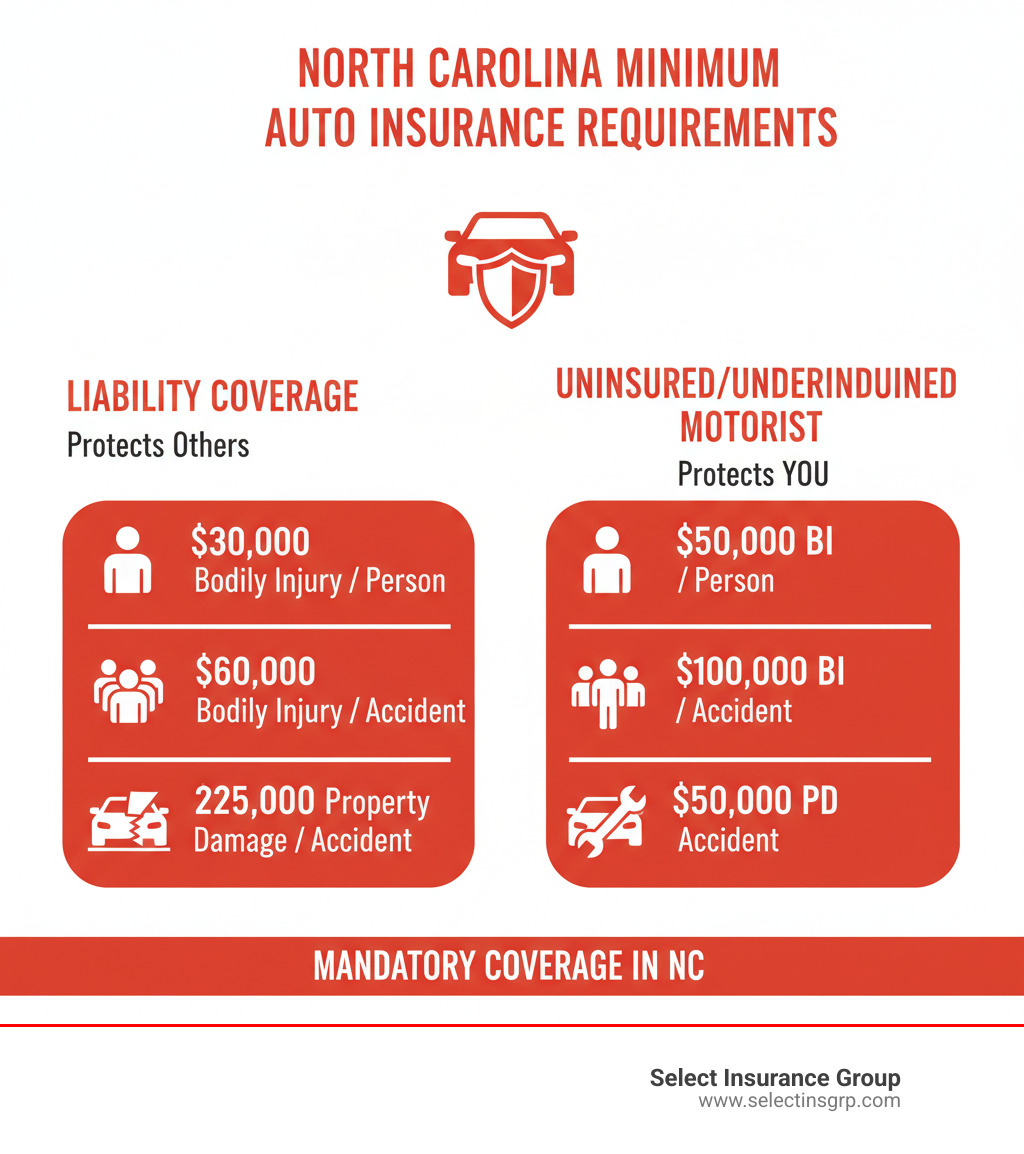

Minimum Car Insurance Requirements in Asheville, NC

Asheville drivers must follow the state-mandated “30/60/25 rule” for liability, plus UM/UIM requirements. This means you must carry:

- $30,000 for bodily injury liability per person

- $60,000 for total bodily injury liability per accident

- $25,000 for property damage liability per accident

Additionally, North Carolina requires:

- $50,000 per person for Uninsured/Underinsured Motorist Bodily Injury

- $100,000 per accident for Uninsured/Underinsured Motorist Bodily Injury

- $50,000 per accident for Uninsured/Underinsured Motorist Property Damage

While these are the legal minimums, consider higher limits. Medical bills and vehicle repairs can easily exceed these amounts, leaving you personally responsible for the rest.

Penalties for Driving Uninsured in Asheville

Driving without proper Car insurance Asheville NC is risky and expensive. The consequences include:

- Fines: A first lapse costs $50, a second $100, and subsequent lapses $150, plus a $50 restoration fee.

- Suspension: Your driver’s license and vehicle registration can be suspended, making it illegal to drive.

- SR-22 Requirement: You may be required to file an SR-22, which labels you a high-risk driver and leads to higher premiums for years.

- Personal Liability: If you cause an accident while uninsured, you are personally responsible for all damages and medical bills, which could lead to lawsuits and financial ruin.

Ensuring continuous coverage protects your finances, driving privileges, and peace of mind.

How Much Does Car Insurance Cost in Asheville, NC?

Good news for your budget: Car insurance Asheville NC is often more affordable than in other parts of the country. Asheville drivers pay around $28 per month for minimum liability and $95 per month for full coverage, which is in line with the North Carolina average and significantly less than the national average of $168 for full coverage. This affordability is due to factors like lower traffic density and a competitive insurance market.

Full Coverage vs. Minimum Liability: What’s the Difference?

“Full coverage” isn’t an official policy type but a term for combining state-required liability with protection for your own vehicle.

- Minimum liability coverage is the bare minimum required by law. It covers damages you cause to others but does not cover your own car.

- Full coverage adds collision and comprehensive coverage. Collision pays for damage to your car from an accident, while comprehensive covers non-collision events like theft, vandalism, fire, hail, or hitting an animal.

| Feature | Minimum Liability | Full Coverage |

|---|---|---|

| Covers damage you cause to others | Yes | Yes |

| Covers your own vehicle | No | Yes |

| Protects against theft | No | Yes (Comprehensive) |

| Covers hitting a deer or other animal | No | Yes (Comprehensive) |

| Required by law | Yes | Only if you have a loan/lease |

| Average monthly cost in Asheville | $28 | $95 |

Full coverage is required for financed or leased vehicles and is highly recommended if your car has significant value. Given Asheville’s unique driving risks, it provides crucial protection.

What Factors Influence Car Insurance in Asheville, NC?

Insurers use many factors to calculate your premium for Car insurance Asheville NC. Understanding them can help you save.

- Driving record: A clean record with no accidents or tickets results in lower rates.

- Vehicle you drive: Newer, more expensive cars cost more to insure. Safety features can earn discounts.

- Annual mileage: Driving less typically means lower premiums.

- Age and experience: Rates are highest for teen drivers and generally decrease with age and experience.

- Credit-based insurance score: In North Carolina, a better credit history can lead to lower premiums.

- ZIP code: Local data on theft, accidents, and weather in your specific Asheville neighborhood affects rates.

- Marital status: Married drivers often receive lower rates than single drivers.

- Coverage limits and deductibles: Higher coverage limits increase premiums, while a higher deductible lowers them.

At Select Insurance Group, we shop across more than 20 carriers to find the one that views your specific factors most favorably, ensuring you get the best rate.

Navigating Asheville’s Unique Driving Environment

Driving in Asheville is unique. The beautiful mountain landscape creates real challenges that drivers in flatter cities don’t face. Key factors include:

- Winding Roads and Steep Grades: Our roads follow the mountain contours, demanding constant driver attention.

- Tourist Traffic: During peak seasons, congestion increases as visitors, often unfamiliar with the roads, slow down to enjoy the scenery.

- Winter Weather: Ice is a major concern. Black ice can form unexpectedly on shaded roads, making them treacherous.

These factors make solid Car insurance Asheville NC essential for preparing for the realities of mountain driving.

Local Road Conditions and Accident Statistics

The numbers highlight the risks of driving in our area. Buncombe County averages 29 fatal accidents annually, with speeding and reckless driving being major contributors on our challenging roads, according to NCDOT’s fatal accidents data.

Infrastructure also plays a role. About 11% of Asheville’s major roadways are in poor condition, and roughly 61% of its bridges need maintenance. These conditions can cause vehicle damage and increase accident risk.

This is where the right Car insurance Asheville NC becomes invaluable. Comprehensive coverage is crucial for non-collision events like hitting a deer on a dark road, while Collision coverage helps with damage from potholes or accidents on winding roads. These coverages address the everyday realities of driving in the Blue Ridge Mountains, and we factor these local conditions into our policy recommendations.

How to Save on Your Asheville Auto Insurance Policy

Finding affordable Car insurance Asheville NC is possible without sacrificing quality coverage. The most effective strategy is to shop around and compare quotes. As an independent agency, we do the heavy lifting by comparing over 40 carriers to find you the best rate.

Available Car Insurance Discounts

Don’t leave money on the table. We help you find every discount you qualify for, including:

- Bundling policies: Combine auto with home or renters insurance for savings of 10-25%.

- Good driver discount: For a clean record with no accidents or tickets.

- Good student discount: For teen drivers who maintain a B average or higher.

- Safety feature discounts: For vehicles with anti-lock brakes, airbags, or anti-theft devices.

- Low-mileage discount: If you work from home or don’t drive often.

- Paid-in-full discount: For paying your entire premium upfront.

- Multi-vehicle discounts: For insuring more than one car.

The Power of Bundling

Bundling is one of the easiest ways to save on Car insurance Asheville NC. By combining multiple policies like your auto and North Carolina Home Insurance with one carrier, you can get a discount of 10% to 25%. Bundling also simplifies your life with one bill, one point of contact, and one renewal date. It creates a streamlined, comprehensive protection strategy for your most valuable assets.

Insurance for Teen Drivers in Asheville

Adding a teen to your policy can be expensive, with average costs around $224 per month for full coverage. However, there are ways to manage this cost. North Carolina’s Graduated Driver’s License (GDL) program helps teens gain experience safely. You can learn more about the rules for young drivers in North Carolina.

To keep costs down:

- Add your teen to your family policy instead of getting a separate one.

- Ask for a good student discount for maintaining a B average or better.

- Insure them on an older, less expensive car with good safety ratings.

- Inquire about low-mileage or defensive driving course discounts.

We can help you explore every option to keep your Car insurance Asheville NC affordable while ensuring your teen is protected.

Frequently Asked Questions about Car Insurance in Asheville

Here are answers to common questions about Car insurance Asheville NC.

What is considered “full coverage” car insurance in North Carolina?

“Full coverage” isn’t an official policy type but an industry term for a policy that includes state-required liability coverages (Bodily Injury, Property Damage, and Uninsured/Underinsured Motorist) plus protection for your own vehicle. This added protection comes from:

- Collision coverage: Pays for repairs to your car if you hit another vehicle or object.

- Comprehensive coverage: Pays for non-collision damage from events like theft, vandalism, fire, hail, or hitting a deer.

Essentially, it means you have coverage for your own vehicle, not just for damages you cause to others.

Is car insurance cheaper in Asheville compared to other NC cities?

Yes. On average, Car insurance Asheville NC rates are among the most affordable in the state. Premiums in larger cities like Charlotte or Fayetteville are often 20-30% higher due to greater traffic congestion and higher accident rates. While individual rates vary, Asheville drivers generally start from a more favorable cost baseline.

How does living in the mountains affect my car insurance?

Insurers use your ZIP code to assess local risks. For Asheville, this includes factors unique to mountain living, such as winding roads, steep grades, winter ice, and a higher likelihood of animal collisions. These risks can influence premiums and make Comprehensive coverage particularly valuable, as it covers non-collision incidents like hitting a deer or weather-related damage. We can help you find the right balance of coverage for your mountain lifestyle.

Find the Best Car Insurance in Asheville Today

Finding the right Car insurance Asheville NC is straightforward with the right partner. We’ve covered the essentials, from state requirements to the unique risks of mountain driving. The good news is that Asheville has some of the most affordable rates in North Carolina, and you can save even more with the right guidance.

This is where local expertise makes a difference. At Select Insurance Group, we’ve spent over three decades helping Asheville drivers. As an independent agency, we shop your policy across more than 40 carriers to find the best combination of price and protection for you.

We understand the local challenges, from winding roads and winter ice to poor road conditions. The right insurance isn’t just about meeting minimums; it’s about balancing cost with real protection so you can enjoy the mountain views with peace of mind.

Ready to find a policy that fits your needs and budget? We’ll do the shopping, compare the options, and provide clear, honest guidance. No pressure, no jargon—just expert help.

Get your personalized North Carolina Auto Insurance quote today, and let’s find you the right policy at the right price.