Why Trucking Insurance Matters for North Carolina Haulers

Trucking insurance NC is a specialized form of commercial auto insurance that protects trucking businesses in North Carolina from financial losses. Whether you run a single truck or manage a fleet, this coverage is both a legal requirement and essential business protection.

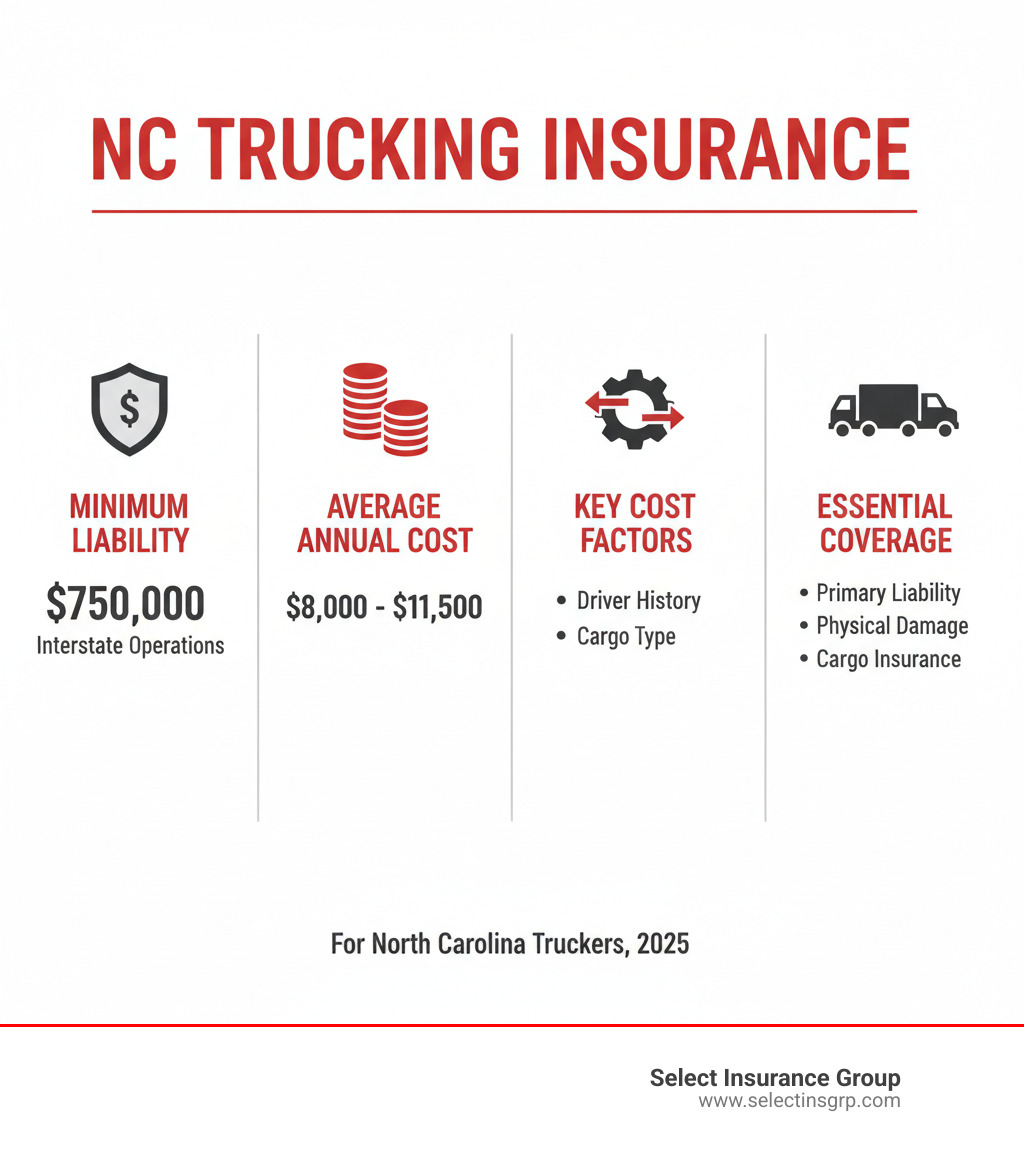

Quick Facts About NC Trucking Insurance:

- Minimum Required Coverage: $750,000 for interstate for-hire operations hauling non-hazardous freight

- Average Annual Cost: $8,000 to $11,500

- Key Coverage Types: Primary Liability, Physical Damage, Motor Truck Cargo, Non-Trucking Liability

- Required for: Commercial trucks over 10,000 GVW operating intrastate, or 26,000+ pounds operating interstate

- Essential Filings: Form E, Form H, MCS-90 endorsement

North Carolina’s trucking industry faces unique risks, from mountain roads to coastal highways. Without proper insurance, a single accident can be financially devastating. Beyond legal compliance with state and federal FMCSA regulations, the right coverage protects your vehicles, cargo, and business reputation. Understanding these requirements is the first step toward protecting your operation.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over three decades of experience, my team and I help trucking businesses find comprehensive trucking insurance NC solutions. We shop across 40+ carriers to ensure you get competitive rates without sacrificing necessary coverage.

Trucking insurance nc further reading:

Navigating the Essentials of Trucking Insurance NC

Operating a commercial truck in North Carolina requires navigating insurance regulations from both state and federal authorities. Understanding these rules is essential for keeping your business legal and running smoothly.

The foundation of trucking insurance NC is financial responsibility. North Carolina law requires commercial vehicle owners to prove they can cover potential damages. For most for-hire carriers transporting non-hazardous property, this means carrying a minimum of $750,000 in liability coverage. This is the legal baseline, reflecting the serious financial impact a commercial vehicle accident can have. You can find more details on the Official NCDMV: Comercial Trucking page.

Regulatory Requirements for Intrastate vs. Interstate Operations

Where your trucks travel determines which regulations apply.

- Intrastate Operations: If you operate entirely within North Carolina, you primarily answer to state regulations. Most intrastate carriers with vehicles over 10,000 pounds still need a USDOT Number to track safety performance.

- Interstate Operations: Crossing state lines brings you under federal FMCSA (Federal Motor Carrier Safety Administration) rules. Many interstate carriers must register under the International Registration Plan (IRP), which simplifies multi-state operations with a single license plate. Learn More info about the International Registration Plan if this applies to you. Additionally, if your vehicle has a taxable gross weight of 55,000 pounds or more, you must file the annual Heavy Vehicle Tax using IRS Form 2290.

Required Insurance Filings and Endorsements

Your insurance company must file specific forms with regulatory bodies as proof of insurance. These filings are vital for maintaining your operating authority.

- Form E & Form H: These state-level filings certify that you meet North Carolina’s minimum liability requirements and that your insurer is authorized to issue policies in the state.

- MCS-90 Endorsement & BMC-97: For interstate carriers, the MCS-90 endorsement guarantees public liability protection up to federal limits, ensuring the public is protected. The BMC-97 filing serves a similar purpose with the FMCSA.

Your insurance provider typically handles these filings. At Select Insurance Group, we ensure all required paperwork is in place so you can focus on your business.

Building Your Policy: Key Coverage Types for NC Truckers

Standard auto insurance won’t protect your commercial operation. You need trucking insurance NC built for the unique risks you face. A policy is built from several types of coverage that work together to protect your business from financial disaster. We can customize a policy to match your operation’s specific needs.

Core Coverages for Every Trucking Operation

These coverages form the foundation of nearly every trucking policy.

- Primary Liability: This is the cornerstone, protecting you when your truck causes bodily injury or property damage to others. While the minimum is often $750,000, many clients choose $1,000,000 limits for greater protection. Learn more in our guide on Truck Liability Coverage.

- Physical Damage: This protects your truck itself from collision, fire, theft, or vandalism. It pays to repair or replace your vehicle, which is often your most valuable business asset.

- Motor Truck Cargo: This protects the goods you’re hauling. If cargo is damaged or stolen, this coverage pays the claim. Shippers often require proof of cargo insurance. Read more about Cargo Insurance for Truckers.

- Uninsured/Underinsured Motorist: This covers your damages if an at-fault driver doesn’t have enough insurance to pay for your medical bills and repairs.

Specialized Coverage for Unique Needs

Depending on your operation, you may need additional protection.

- General Liability: This covers business risks that don’t involve your truck, such as a customer slipping at your office or accidental damage to a client’s loading dock. Explore North Carolina General Liability options.

- Bobtail and Non-Trucking Liability (NTL): Essential for leased owner-operators. Bobtail covers your tractor when you’re driving without a trailer between jobs. NTL covers you when using the truck for personal, non-business reasons. We can help you determine which you need. See our page on Owner Operator Semi Truck Insurance for details.

- Trailer Interchange: This is crucial if you haul trailers you don’t own. It covers damage to a non-owned trailer while it’s in your possession.

- Workers’ Compensation: Required by law in North Carolina if you have employees. It covers medical expenses and lost wages for employees injured on the job. Learn about your obligations with North Carolina Workers Compensation.

Other specialized coverages include excess liability, hired and non-owned auto, and cyber liability. We’ll help you build a comprehensive shield for your business.

Decoding the Costs: Factors Influencing Your NC Trucking Insurance Premiums

What will trucking insurance NC cost your business? While every operation’s risk profile is unique, we typically see annual premiums ranging from $8,000 to $11,500. Where your business falls in that range depends on how insurers assess your risk.

Understanding the factors insurers evaluate gives you the power to influence your costs. A local hauler in Raleigh faces different risks than a long-haul refrigerated carrier, and your rates will reflect that. For more context, see our breakdown of Average Truck Insurance Cost.

How Driver History Impacts Your trucking insurance nc Premiums

Your drivers’ history behind the wheel has a massive impact on your premium. Insurers look closely at:

- Driver Experience and Age: Seasoned drivers with years of clean CDL history are less risky and cheaper to insure than new drivers. Age can also be a factor, with very young or older drivers sometimes seeing higher rates.

- Motor Vehicle Record (MVR): Insurers pull MVRs for all drivers, looking back 3-5 years. Speeding tickets, at-fault accidents, and other violations signal higher risk and lead to higher premiums. A clean MVR is one of the best ways to keep costs down.

- Safety Training: Companies that invest in comprehensive driver training, safety meetings, and reward programs for safe driving often qualify for discounts. This shows insurers you are proactively managing risk.

The Role of Your Vehicle, Cargo, and Operations

What you drive and what you haul are just as important as who is driving.

- Vehicle and Equipment: Newer trucks with advanced safety features (automatic braking, lane departure warnings) can earn liability discounts. While older trucks may have a lower replacement cost, a solid maintenance record is key to proving reliability. The type, size, and Gross Vehicle Weight (GVW) of your truck also affect rates, as heavier or more specialized vehicles can cause more damage or be more expensive to repair.

- Cargo Type: The goods you transport are a major cost driver. General freight is the least expensive to insure. High-value goods (electronics), perishables, or hazardous materials require higher liability and cargo limits, increasing your premium.

- Hauling Radius and Mileage: Your area of operation determines your exposure. A local carrier running a 50-mile radius has less road exposure than a long-haul operator driving cross-country. More miles and interstate travel typically lead to higher premiums.

- Fleet Size: Larger fleets may access better pricing structures, but the overall premium will be higher due to more vehicles and drivers. We can help find carriers who specialize in pricing fleet coverage competitively.

From Quote to Claim: Managing Your Policy

Securing the right trucking insurance NC is just the beginning. We act as your long-term partner, helping you manage your policy and steer the claims process. We’re here to make insurance as smooth as possible so you can focus on keeping your trucks rolling.

How to Get a Quote for trucking insurance nc

We’ve streamlined our process to make getting a quote painless. By shopping your coverage across our network of 40+ carriers, we find the best combination of price and protection. To get started, we’ll need key information about your business:

- Business & Driver Details: Your USDOT number, and for each driver, their CDL number, date of birth, and years of experience.

- Vehicle Information: The VIN, year, make, model, and gross vehicle weight for each truck and trailer.

- Operations: Your typical hauling radius (local, regional, long-haul), the types of cargo you transport, and your annual mileage.

- Insurance History: A record of any past claims.

Once we have this information, we compare options to find the right fit for your operation. We also handle broader North Carolina Business Auto coverage needs.

What to Do When Filing a Claim

Accidents happen. When they do, knowing what to do can ensure your claim is resolved quickly and smoothly.

- Ensure Safety: Your first priority is safety. If anyone is injured, call 911 immediately.

- Notify Your Insurer: Report the incident as soon as possible. The sooner you report, the sooner the claims process can begin. You can contact us directly to help coordinate.

- Document Everything: Use your phone to take photos and videos of the scene, including vehicle damage, cargo, and road conditions. Gather as much evidence as possible.

- File a Police Report: An official report provides an objective account of the incident, which is crucial for your claim.

- Cooperate with the Adjuster: Be honest and provide any requested documentation promptly. This helps the process move forward efficiently.

After a claim, we can help you connect with access risk management resources to strengthen your safety protocols and prevent future incidents. We stay involved throughout the claims process to ensure you get the support you need to get back on the road.

Frequently Asked Questions about NC Trucking Insurance

We get a lot of great questions about trucking insurance NC. Here are answers to some of the most common inquiries.

What are the minimum liability limits for different cargo types in North Carolina?

Minimum liability limits depend on what you haul and where you drive. For both intrastate and interstate carriers, the requirements are often aligned:

- General Freight: Most carriers hauling non-hazardous property need at least $750,000 in liability coverage. Many contracts require $1,000,000.

- Oil Transport: The minimum is typically $1,000,000.

- Hazardous Materials: Depending on the type and quantity, minimums range from $1,000,000 to $5,000,000.

- Passenger Carriers: Vehicles seating 16+ passengers need $5,000,000, while those with 15 or fewer need $1,500,000.

These are legal minimums. Many businesses choose higher limits for better protection.

What is the difference between Bobtail and Non-Trucking Liability insurance?

These coverages are for owner-operators leased to a carrier, but they apply in different situations.

- Bobtail Insurance: Covers your tractor when you are driving it without a trailer attached between jobs (e.g., driving home after dropping off a trailer).

- Non-Trucking Liability (NTL): Covers your truck when you are using it for personal, non-business reasons while not under dispatch (e.g., running errands on the weekend).

Both fill gaps left by your motor carrier’s primary liability policy. For more details, see our guide to Owner Operator Semi Truck Insurance.

How can I lower my trucking insurance premiums?

While insurance is a significant expense, there are proven ways to manage your costs:

- Maintain Clean Driving Records: A history free of accidents and violations is the most effective way to lower premiums.

- Implement a Safety Program: Documented training and safety protocols can earn you significant discounts.

- Choose a Higher Deductible: A higher out-of-pocket deductible can lower your premium, but be sure you have the cash reserves to cover it.

- Use Technology: Discounts are often available for trucks with telematics devices and modern safety features like collision avoidance systems.

- Bundle Policies: Combining your trucking insurance with other commercial policies like general liability can lead to savings.

- Keep Up with Maintenance: Well-maintained trucks are seen as less risky. Keep detailed service records.

- Work with an Experienced Agent: We shop the market across 40+ carriers to find the most competitive rates for your specific operation.

Conclusion

Navigating trucking insurance NC is critical to building a successful hauling business in North Carolina. From meeting the $750,000 minimum liability requirement to understanding the coverages that protect your assets, the right policy is your foundation for success.

Compliance keeps you legal, but comprehensive coverage keeps you in business. A single major accident can be devastating without the right protection. That’s where partnering with an expert makes all the difference. At Select Insurance Group, we bring over three decades of experience to the table. Our ability to shop across more than 40 carriers means we work for you, finding competitive rates that protect your bottom line without cutting corners on coverage.

We translate the complex into the simple, ensuring you understand your policy and feel confident in your protection. Your business keeps North Carolina moving; let us handle the insurance details so you can focus on the road ahead.

Get Your Custom North Carolina Commercial Insurance Quote Today