Why Car Insurance Durham NC Matters for Every Driver

Car insurance Durham NC is a legal requirement and financial safety net for all drivers in the Bull City. If you’re looking for coverage, here’s what you need to know:

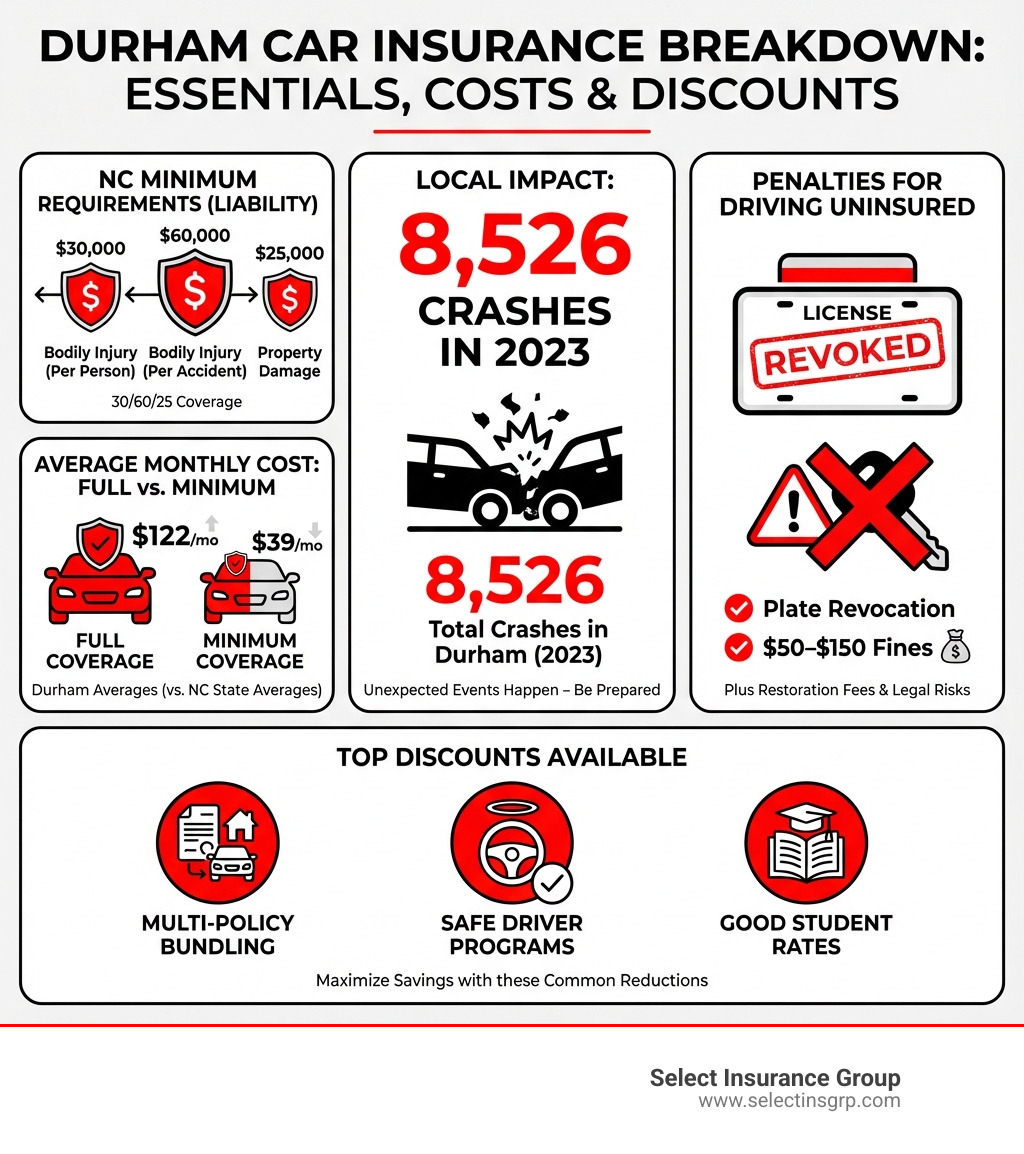

Quick Answer: Durham Car Insurance Essentials

- Minimum Required Coverage: $30,000 bodily injury per person / $60,000 per accident / $25,000 property damage

- Average Full Coverage Cost: $122/month (vs. $110 state average)

- Average Minimum Coverage Cost: $39/month (vs. $34 state average)

- Key Factors Affecting Rates: Age, driving history, vehicle type, ZIP code

- Driving Without Insurance: License plate revocation, $50-$150 fines, restoration fees

Durham is home to Research Triangle Park, Duke University, and a growing population of over 250,000 residents. Whether you’re navigating the Durham Freeway or city streets near Bennett Place, unexpected events happen. In 2023 alone, Durham saw 8,526 crashes resulting in 30 fatalities and 3,200 injuries. These numbers underscore why having the right auto insurance isn’t just about following the law—it’s about protecting yourself, your passengers, and your financial future.

Finding affordable coverage that meets North Carolina’s requirements while fitting your budget can feel overwhelming. You need to understand minimum liability limits, decide between full and minimum coverage, and explore available discounts like multi-policy bundling, safe driver programs, and good student rates.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, with over three decades of experience helping Southeastern drivers secure comprehensive car insurance Durham NC coverage. My team and I work with more than 20 carriers to find competitive rates and personalized protection for Durham residents.

Simple guide to Car insurance Durham NC terms:

- NC auto insurance requirements

- NC auto insurance companies

- where in north carolina is auto insurance the least expensive

Understanding Car Insurance Costs in Durham

This section will break down the financial aspects of insuring a vehicle in Durham, helping drivers budget effectively.

When it comes to securing car insurance Durham NC, one of the first questions on everyone’s mind is, “How much will it cost?” The answer, as you might expect, isn’t always straightforward. It’s influenced by a myriad of factors, from your personal driving habits to the type of car you own and even your specific neighborhood in Durham. Understanding these costs and the factors behind them is key to finding a policy that offers both robust protection and financial peace of mind.

Average Cost of Car Insurance Durham NC

Let’s talk numbers. On average, full coverage car insurance Durham NC costs approximately $122 per month. This is slightly higher than the North Carolina state average of $110 per month, reflecting Durham’s unique driving environment and population density. For those opting for minimum coverage, Durham drivers typically pay around $39 per month, which also edges out the state average of $34 per month.

To put this into perspective, both full and minimum coverage rates in Durham are considerably lower than the national averages, which stand at $223 per month for full coverage and $67 per month for minimum coverage. So, while Durham rates are a bit above the NC state average, we’re still often in a better position than many other parts of the country!

How Rates Vary by Personal Factors

Your individual profile plays a significant role in determining your insurance premiums. Insurers look at various personal factors to assess risk.

- Age: This is a huge one. Teenagers, due to their limited driving experience, face significantly higher rates. For example, teenagers in Durham pay an average of $264 per month for full coverage car insurance. As drivers mature and gain more experience, rates tend to decrease. Drivers in their 30s in Durham pay an average of $122 per month for full coverage, aligning with the city’s overall average. Rates typically remain stable through your 40s, 50s, and 60s, before potentially seeing a slight increase again in your 70s.

| Age Group | Average Monthly Full Coverage Rate (Durham, NC) | Average Monthly Liability Coverage Rate (Durham, NC) |

|---|---|---|

| Teenagers | $264 | $93 |

| 20s | $141 | $45 |

| 30s | $122 | $39 |

| 40s | $120 | $38 |

| 50s | $117 | $38 |

| 60s | $113 | $37 |

| 70s | $119 | $40 |

- Driving History: A clean driving record is your best friend when it comes to insurance rates. Accidents, speeding tickets, or other moving violations signal higher risk to insurers, leading to increased premiums. Conversely, a history of safe driving can open up significant discounts.

- Vehicle Type: The make, model, year, and safety features of your car all affect your rates. More expensive cars, sports cars, or vehicles with higher theft rates typically cost more to insure. Cars with advanced safety features, on the other hand, might qualify for discounts.

- ZIP Code Variations: Even within Durham, your specific ZIP code can influence your rates. Areas with higher traffic density, crime rates, or accident statistics might see slightly higher premiums. Average full coverage rates by zip code in Durham can range from $97 to $124 per month, while liability rates vary from $30 to $40 per month.

The Difference Between Full Coverage and Minimum Insurance

Understanding the distinction between full coverage and minimum insurance is crucial for any driver, especially when navigating options for car insurance Durham NC.

-

Minimum Coverage (Liability Insurance): This is the baseline, legally required insurance in North Carolina. It includes:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering for others if you’re at fault in an accident.

- Property Damage Liability: Covers damage to other people’s property (like their car, fence, or building) if you’re at fault.

Minimum coverage is designed to protect other drivers and their property, not your own vehicle or injuries.

-

Full Coverage: While “full coverage” isn’t a single policy, it’s a common term for a combination of policies that provide broader protection. Typically, it includes your state’s minimum liability requirements, plus:

- Collision Coverage: Pays for damage to your own vehicle resulting from a collision with another car, an object (like a tree), or a rollover, regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your car from non-collision events such as theft, vandalism, fire, hail, floods, or striking an animal.

- Often, policies also include Uninsured/Underinsured Motorist (UM/UIM) Coverage, which protects you if you’re hit by a driver who doesn’t have enough (or any) insurance. While not strictly mandated in North Carolina, we highly recommend this crucial protection.

When is minimum coverage sufficient? Generally, if you own an older, low-value car that you could easily replace out-of-pocket, minimum coverage might seem appealing due to its lower cost. However, remember it leaves you personally responsible for damages to your own vehicle.

When is full coverage recommended? If you have a newer car, a car with a high market value, or a financed/leased vehicle, full coverage is almost always a necessity. Lenders typically require collision and comprehensive coverage to protect their investment. Beyond that, it offers far greater financial security and peace of mind, especially given the costs of vehicle repairs today.

For more detailed information on auto insurance in the state, explore our guide to North Carolina Auto Insurance.

North Carolina’s Legal Requirements and Penalties

This section outlines the essential legal framework for drivers in Durham to ensure they stay compliant and avoid penalties.

Driving in North Carolina comes with a clear set of legal obligations, and securing proper car insurance Durham NC is paramount among them. These requirements are in place not just to protect you, but everyone else on the road. Understanding these mandates and the consequences of ignoring them is crucial for every responsible driver in the Bull City.

State-Mandated Minimum Coverage

North Carolina law is explicit about the minimum liability coverage all drivers must carry. This is often referred to as the “30/60/25 rule”:

- $30,000 for bodily injury per person: This is the maximum amount your insurance will pay for injuries to one person in an accident you cause.

- $60,000 for bodily injury per accident: This is the total maximum your insurance will pay for all injuries in an accident you cause, regardless of how many people are hurt.

- $25,000 for property damage per accident: This is the maximum your insurance will pay for damage to another person’s property (like their vehicle) in an accident you cause.

While these are the minimums, they might not be enough to cover the full costs of a serious accident. Medical bills and vehicle repair costs can quickly exceed these limits, leaving you personally responsible for the remainder. This is why we often recommend higher liability limits for greater protection.

Additionally, while not mandated, we strongly advise considering Uninsured/Underinsured Motorist (UM/UIM) coverage. This protects you and your passengers if you’re involved in an accident with a driver who either has no insurance or insufficient insurance to cover your damages and medical expenses. Given the number of vehicles on the road, it’s a vital layer of protection.

Penalties for Driving Without Car Insurance Durham NC

Ignoring North Carolina’s mandatory insurance laws can lead to severe consequences. The state takes driving without proper coverage very seriously, and the penalties can be costly and inconvenient.

- License Plate Revocation: If your liability insurance lapses or is canceled, your vehicle’s license plate can be revoked by the North Carolina Division of Motor Vehicles (DMV). This means you cannot legally drive your vehicle.

- Civil Penalties: For a first offense of driving without insurance, you could face a civil penalty of $50. For a second offense, it jumps to $100, and for a third or subsequent offense, it’s $150. These penalties are in addition to any other fees or fines.

- Restoration Fees: Once your license plate is revoked, you’ll need to pay a $50 restoration fee to reinstate it, assuming you’ve secured new insurance.

- DMV Notification System: Insurance companies in North Carolina are legally required to notify the DMV if a policy is canceled or lapses. This system ensures that the state is aware of uninsured drivers and can take appropriate action.

Beyond these official penalties, driving without insurance also exposes you to significant financial risk. If you cause an accident without coverage, you could be held personally liable for all damages and injuries, potentially leading to lawsuits, wage garnishment, and financial ruin. It’s simply not worth the risk.

How to Save on Your Durham Auto Policy

This section provides actionable tips for drivers to lower their insurance premiums without sacrificing necessary protection.

Who doesn’t love a good deal, especially when it comes to essential expenses like car insurance Durham NC? While we’ve discussed how rates are determined, there are plenty of proactive steps you can take to significantly reduce your premiums. It’s not just about finding the cheapest policy; it’s about finding the best value that offers comprehensive protection without breaking the bank.

Common Car Insurance Discounts

Insurance providers offer a variety of discounts designed to reward safe driving habits, responsible financial choices, and even academic achievements. Here are some of the most common ones we help our Durham clients find:

- Multi-policy Discount: This is one of the easiest ways to save. By bundling your car insurance with other policies, such as home, renters, or even motorcycle insurance, you can often qualify for a substantial discount on all policies.

- Good Student Discount: If you have a young driver in your household (typically aged 16-24) who maintains a “B” average or better and is a full-time student, they may be eligible for a discount. It’s a great way to reward their academic efforts!

- Safe Driver Discount: A clean driving record is golden. If you have a history of accident-free driving (often 3-5 years without claims), you can qualify for significant savings. Some insurers also offer programs that monitor driving behavior (like telematics devices or apps) and reward safe habits with even deeper discounts.

- Anti-theft Device Discount: Installing an approved anti-theft device in your vehicle can make it less appealing to thieves, and insurers often pass those savings on to you in the form of a discount.

- Defensive Driving Course Discount: For drivers aged 55 and older, completing an approved defensive driving course can lead to a discount. It shows insurers you’re committed to staying sharp behind the wheel.

- Paid-in-Full Discount: If you’re able to pay your entire annual premium upfront, many insurers will offer a discount for the convenience and reduced administrative costs.

- Automatic Payments/Paperless Billing: Setting up recurring bill pay from your checking or savings account, or opting for paperless statements, can also earn you small but worthwhile discounts.

We’re experts at uncovering every discount you qualify for, ensuring you maximize your savings on car insurance Durham NC.

The Power of Bundling

As mentioned, the multi-policy discount is a powerful tool for savings. But bundling goes beyond just a discount; it simplifies your entire insurance life. When you combine policies like your auto insurance with North Carolina Home Insurance or renters insurance, you often benefit from:

- Increased Savings: The discounts for bundling are usually more significant than individual policy discounts.

- Simplified Billing: Instead of managing multiple bills from different providers, you often get one consolidated bill, making budgeting easier.

- Convenience: All your insurance needs are handled by one provider and often one agent, streamlining communication and policy management.

Whether you own a home, rent an apartment, or even have a motorcycle, combining your policies with us is a smart move that can lead to substantial financial benefits.

Driving Conditions and Their Impact

Durham’s road infrastructure and driving conditions can indirectly influence insurance rates. Insurers analyze local accident data, traffic patterns, and even road quality when calculating premiums for specific areas.

- Durham Road Infrastructure: The city’s mix of urban streets, suburban thoroughfares, and major arteries like the Durham Freeway and I-40 means varied driving environments. Areas with higher traffic volume or more complex intersections might experience more frequent accidents.

- Accident Statistics: The numbers speak for themselves. In 2023, Durham experienced 8,526 crashes, resulting in 30 fatalities and 3,200 injuries. These statistics reflect the real risks on Durham roads and are a factor in overall premium calculations. Higher accident rates in a given area can lead to slightly liftd insurance costs for drivers residing there.

- Driving Behavior: While infrastructure plays a role, individual driving behavior is paramount. The presence of these statistics serves as a reminder that accidents, unfortunately, are a reality. Maintaining safe driving habits is the best way to keep yourself safe and potentially lower your premiums.

For official North Carolina crash data and further insights into road safety, you can visit the Official NC crash data website.

Finding the Best Car Insurance Durham NC

This section guides readers on how to find the right insurance provider and policy for their specific needs in the Durham area.

Navigating the landscape of car insurance Durham NC can feel like a quest, but finding the “best” policy isn’t about chasing the lowest price; it’s about securing the right coverage for your unique situation at a competitive rate. With so many options available, knowing where to start and who to trust makes all the difference.

Working with an Independent Insurance Agent

When it comes to finding optimal car insurance Durham NC, working with an independent insurance agent is often your most strategic move. Unlike captive agents who represent only one insurance company, independent agents like us work with multiple carriers. This gives you several distinct advantages:

- Access to Multiple Carriers: We shop around for you! Instead of you having to get quotes from dozens of different companies, we can compare policies and prices from a wide range of providers (we work with over 40 carriers) to find the best fit for your needs and budget. This means you’re more likely to find competitive rates and comprehensive coverage options.

- Personalized Service: We take the time to understand your specific circumstances – your driving history, vehicle, lifestyle, and financial goals. This personalized approach ensures that your policy is custom to you, not just a generic package.

- Expert Advice: With decades of experience, we possess in-depth knowledge of North Carolina’s insurance laws, local driving conditions, and the nuances of various policies. We can explain complex terms, highlight potential gaps in coverage, and advise you on the right deductibles and limits. We’re here to answer your questions and guide you through the entire purchasing process.

- Local Knowledge: As part of the Durham community, we understand the specific challenges and opportunities that local drivers face. This local insight helps us recommend the most relevant and effective coverage.

Choosing an independent agent means having a dedicated advocate in your corner, simplifying the process and giving you confidence in your insurance decisions. If you’re looking to compare options from various providers, you can learn more about NC auto insurance companies and how we work with them to serve you.

Other Vehicle Insurance Options

While our focus here is on car insurance Durham NC, it’s worth noting that our expertise extends to protecting all your valuable vehicles. Whether you’re a business owner, a weekend adventurer, or a two-wheeled enthusiast, we can help you find specialized coverage:

- Commercial Auto Insurance: If you use vehicles for your business, standard personal auto insurance won’t cut it. We can help you steer the complexities of North Carolina Commercial Insurance to protect your fleet, employees, and operations.

- Motorcycle Insurance: The thrill of the open road comes with its own risks. We offer comprehensive North Carolina Motorcycle Insurance to cover your bike, gear, and any liabilities you might face.

- RV Insurance: For those who love to explore, an RV is more than just a vehicle – it’s a home on wheels. Our North Carolina RV Insurance provides specialized protection whether you’re cruising down the highway or parked at a campsite.

No matter what you drive, we’re here to ensure it’s properly protected with custom insurance solutions.

Frequently Asked Questions about Durham Car Insurance

It’s natural to have questions when dealing with something as important as car insurance Durham NC. Here, we address some of the most common inquiries we receive, offering clear and concise answers to help you steer your coverage with confidence.

What is the first thing I should do after a car accident in Durham?

Accidents are stressful, but knowing what to do immediately afterward can make a huge difference.

- Prioritize Safety and Call 911: First and foremost, check for injuries. If anyone is hurt, or if there’s significant damage, call 911 immediately. Move your vehicle to a safe location if possible and if it’s safe to do so.

- Exchange Information: Get the other driver’s name, address, phone number, vehicle make/model, license plate number, driver’s license number, and insurance information (company and policy number). Also, gather contact details for any witnesses.

- Document the Scene: Use your phone to take photos of the accident scene, vehicle damage, road conditions, and any relevant traffic signs. If you can’t write, take pictures of the other driver’s license, registration, and proof of insurance.

- Avoid Admitting Fault: Even if you think you’re at fault, do not admit it at the scene. Stick to the facts when speaking with police and other parties.

- Notify Your Insurance Agent: As soon as you’re safe and able, contact your insurance agent or provider. They will guide you through the claims process. We are here to help you through every step, offering support and advice.

How does a speeding ticket affect my car insurance in Durham?

A speeding ticket, unfortunately, can have a noticeable impact on your car insurance Durham NC rates. Insurers view traffic violations as indicators of increased risk, and they often adjust premiums accordingly.

- Rate Increases: Even a single speeding ticket can lead to a rate increase, especially if it’s a significant violation or if it’s not your first offense. The exact increase will depend on your insurer, your driving record, and how fast you were going.

- Points on License: In North Carolina, speeding tickets result in points being added to your driving record. Accumulating too many points can lead to license suspension and further signal high risk to insurers.

- Impact on Safe Driver Discounts: A speeding ticket can cause you to lose any safe driver discounts you currently enjoy, or prevent you from qualifying for them in the future. This double-whammy can make the financial impact even greater.

Maintaining a clean driving record is one of the most effective ways to keep your insurance costs down.

Can I get insurance with a poor driving record in Durham?

Yes, absolutely! While having a poor driving record (due to accidents, multiple tickets, or more serious infractions like DUIs) will make finding affordable car insurance Durham NC more challenging, it’s certainly not impossible.

- High-Risk Insurance: You may be classified as a “high-risk” driver, which means you’ll likely pay higher premiums. However, there are specialized insurance companies and programs designed to cover high-risk drivers.

- SR-22 Requirements: In some cases, after certain violations, you might be required to file an SR-22 form (proof of financial responsibility) with the North Carolina DMV. This isn’t insurance itself, but a certification from your insurer that you carry the state’s minimum liability coverage.

- Working with an Agent: This is where an independent agent truly shines. We have access to a wide network of insurance carriers, including those that specialize in high-risk policies. We can shop around on your behalf to find the most competitive rates and help you steer any SR-22 requirements, guiding you towards options that allow you to get back on the road legally and responsibly. Over time, with a clean driving record, you can work towards lower premiums again.

Your Trusted Partner for Durham Auto Insurance

Navigating car insurance in Durham requires understanding local costs, legal mandates, and savings opportunities. By comparing quotes, seeking discounts, and working with a knowledgeable agent, you can secure a policy that offers both protection and peace of mind. Select Insurance Group has the expertise to guide you through the process, ensuring you find the best coverage for your needs. Get a quote for North Carolina Auto Insurance