Why Finding the Right Auto Insurance in Orlando Matters

Orlando fl auto insurance can feel overwhelming, but here’s what you need to know right now:

Quick Facts for Orlando Drivers:

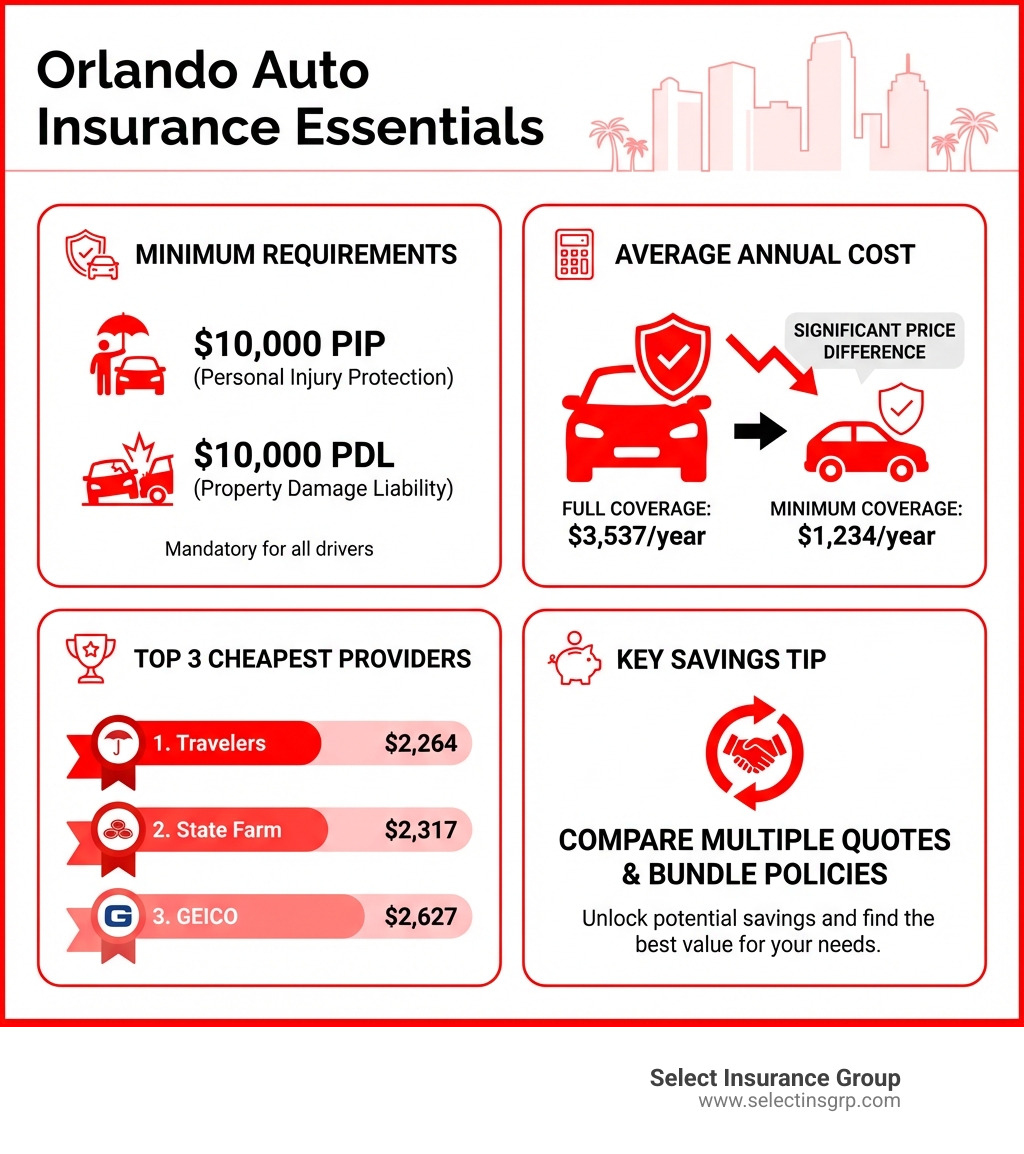

- Minimum Required Coverage: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL)

- Average Full Coverage Cost: $3,537 per year ($295/month)

- Average Minimum Coverage Cost: $1,234 per year ($103/month)

- #1 Money-Saving Tip: Compare quotes from multiple carriers—drivers save an average of $600-$800 by shopping around

Orlando is home to world-famous theme parks, millions of tourists, and some of Florida’s most challenging roads. The I-4 corridor is one of America’s most congested highways, and unpredictable weather from downpours to hurricanes means Orlando drivers face unique risks.

In 2024, Orlando had 20,079 car accidents, leading to 35 deaths and 444 serious injuries. These numbers represent real people whose lives were changed instantly. Navigating tourist traffic and sudden storms makes the right car insurance more than a legal requirement—it’s your financial safety net.

The truth is simple: Florida’s no-fault laws differ from most states. Orlando’s unique conditions mean you need coverage that truly protects you, not just the bare minimum.

This guide covers everything about Orlando car insurance: legal requirements, what full coverage means, expected costs, and how to find affordable, protective coverage for your family and assets.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, and I’ve spent over three decades helping drivers across the Southeast—including thousands of Orlando residents—find the right orlando fl auto insurance coverage at rates that fit their budgets. Our team works with 40+ carriers to ensure you get both the protection you need and the price you deserve.

Simple orlando fl auto insurance word guide:

- auto insurance agents in orlando fl

- auto insurance companies orlando fl

- what is the average auto insurance price in orlando florida

Understanding Orlando’s Legal Insurance Requirements

Driving in Florida requires having adequate auto insurance. Understanding the state’s clear legal requirements is the first step to protecting yourself and staying compliant. It’s not just about avoiding a ticket; it’s about safeguarding your financial future. For a comprehensive look, see our Minimum Auto Insurance Florida Guide.

Florida’s Minimum Car Insurance Requirements

What does Florida require? Unlike many states, Florida’s “no-fault” status means minimum requirements focus on immediate medical care and property damage. To register a vehicle with four wheels, you must prove you have two key coverages:

- Personal Injury Protection (PIP): This is the cornerstone of Florida’s no-fault system. PIP covers 80% of necessary and reasonable medical expenses, up to $10,000, resulting from a covered injury, regardless of who caused the crash. It also covers 60% of lost wages and replacement services up to the same limit. This means your own insurance company pays for your medical bills and lost income after an accident, regardless of fault.

- Property Damage Liability (PDL): PDL covers damage to another person’s property caused by you or someone else driving your insured vehicle. This means if you’re at fault in an accident and damage another car, a fence, or even a mailbox, your PDL coverage will help pay for those repairs. The minimum requirement for PDL in Florida is $10,000 per accident.

Key takeaway: Florida requires $10,000 in PIP and $10,000 in PDL. The state’s continuous coverage rule mandates that any registered vehicle must have insurance, even if it’s not being driven. Find more details at Florida’s official insurance requirements.

How Florida’s “No-Fault” System Affects You

Florida’s “no-fault” system, in place since 1972, is designed to streamline post-accident medical care. Here’s what it means for Orlando drivers:

- Your PIP is Primary: Your PIP coverage pays for your medical expenses and lost wages up to your policy limit, regardless of who was at fault for the accident. This differs from “at-fault” states where the responsible driver’s insurance would pay.

- Faster Medical Care: The idea behind no-fault is to ensure accident victims receive prompt medical attention without having to wait for fault to be determined.

- Restrictions on Lawsuits: While no-fault ensures your medical bills are covered, it also restricts your right to sue the at-fault driver for pain and suffering. You can only pursue a lawsuit for non-economic damages if your injuries meet a certain “severe injury threshold,” as defined by state law.

This system aims to reduce litigation and ensure quick access to benefits, highlighting the importance of adequate PIP coverage. For more background, explore information on background on no-fault insurance.

The Consequences of Driving Uninsured in Orlando

Driving uninsured in Florida is a serious offense with significant penalties that can impact your driving privileges and finances.

If you’re caught driving uninsured, you could face:

- Fines: Initial fines typically range from $150 to $500.

- License and Registration Suspension: Your driver’s license, vehicle registration, and license plates can be suspended for up to three years.

- Reinstatement Fees: To get your license and registration back, you’ll pay reinstatement fees starting at $150 for a first offense and increasing to $500 for a third offense within three years.

- SR-22 Requirement: After a suspension for driving without insurance, you’ll likely need an SR-22 certificate. This is a form filed by your insurer with the state, proving you have coverage, but it usually leads to significantly higher insurance premiums.

These consequences show why continuous coverage is a smart financial decision, not just a legal one. It’s better to be prepared than to face the costs of driving uninsured.

Decoding the Cost of Orlando FL Auto Insurance

A common question about orlando fl auto insurance is, “How much will it cost?” The answer isn’t simple. While average premiums are a good starting point, your specific rate depends on many factors. Let’s break down what to expect and what influences the cost.

Average Premiums in Orlando: A Snapshot

Orlando’s vibrant atmosphere and constant flow of tourists, combined with Florida’s unique insurance laws, mean that car insurance rates can be quite different from other parts of the country.

- Average Full Coverage Cost: For full coverage, Orlando residents can expect to pay an average of $3,537 annually, or about $295 per month.

- Average Minimum Coverage Cost: If you opt for just the state-mandated minimum coverage, the average cost in Orlando is around $1,234 annually, or about $103 per month.

How does this compare? Florida’s average car insurance cost in 2024 was $3,682, much higher than the national average of $1,548. Orlando’s full coverage average is slightly below the state average. These are just averages. Your rate will vary based on your profile and ZIP code, as local factors like accident rates and population density affect premiums.

While some providers consistently offer competitive rates, the best way to find your cheapest rate is to compare multiple quotes, which is where we excel!

Key Factors That Determine Your Insurance Rate

Your car insurance premium is calculated using a complex algorithm to assess risk. Dozens of factors determine your final rate. Understanding them can help you find ways to save.

Here are some of the most influential factors:

- Your Driving Record: This is paramount. A clean driving record with no accidents or traffic violations will almost always result in lower premiums. Conversely, a history of speeding tickets, at-fault accidents, or DUIs will significantly increase your rates.

- Vehicle Make and Model: The type of car you drive matters. More expensive vehicles, sports cars, or those with higher repair costs often cost more to insure. Safety ratings, the likelihood of theft, and the cost of parts all factor in.

- Annual Mileage: The more you drive, the higher your risk of being in an accident. If you have a long commute or use your car frequently, you might pay more than someone who drives sparingly.

- Age and Gender: Younger, less experienced drivers (especially teenagers) typically face the highest rates due to statistical data showing a higher incidence of accidents. Rates tend to decrease as drivers mature, usually stabilizing in their 30s and 40s, before potentially rising again for very senior drivers.

- Credit-Based Insurance Score: In Florida, your credit history can impact your insurance rates. Insurers often use a credit-based insurance score to predict the likelihood of you filing a claim. A higher score often translates to lower premiums.

- Coverage Limits and Deductible Amount: The amount of coverage you choose directly impacts your premium. Similarly, your deductible—the amount you pay out-of-pocket before insurance kicks in—also plays a role. A higher deductible usually means a lower premium, and vice-versa.

- Your Location (ZIP Code): As discussed, even within Orlando, rates can vary by ZIP code based on local accident rates, theft statistics, and population density.

Understanding these factors helps you see how your circumstances influence your orlando fl auto insurance costs.

Building Your Ideal Policy: Coverage Options Explained

Choosing the right orlando fl auto insurance options goes beyond legal minimums. It’s about protecting your assets, financial well-being, and managing risk. Relying only on PIP and PDL can leave you vulnerable. We’ll help you understand your choices to build a protective policy. For a deeper dive, explore our Florida Auto Insurance.

What is “Full Coverage” Auto Insurance?

The term “full coverage” isn’t a specific policy but a combination of coverages providing comprehensive protection for your vehicle, regardless of fault. It usually includes:

- Collision Coverage: This pays for damages to your own vehicle if you hit another car, an object (like a tree or pole), or if your car rolls over. It covers repairs or the actual cash value of your car, minus your deductible, even if you are at fault.

- Comprehensive Coverage: This protects your vehicle from damages that aren’t collision-related. Think of it as “other than collision.” This includes perils like theft, vandalism, fire, falling objects, animal strikes, and damage from natural disasters such as hurricanes and floods—a very real concern for Orlando residents.

When is “full coverage” required?

While not legally mandated for all drivers, “full coverage” is almost always required if you lease or finance a vehicle. Lenders require it to protect their investment. Even if you own your car outright, these coverages are essential if you can’t afford to repair or replace it out-of-pocket.

Essential Optional Coverages for Orlando Drivers

Given Orlando’s busy roads and Florida’s no-fault system, we strongly recommend considering coverages beyond the minimums.

- Bodily Injury Liability (BIL): Though not legally required in Florida, Bodily Injury Liability (BIL) is one of the most critical coverages. If you’re at fault in an accident that injures someone, BIL pays for their medical bills, lost wages, and pain and suffering. Without it, you could be sued personally, risking your home, savings, and future earnings. We recommend carrying limits much higher than the typical minimums suggested for this optional coverage.

- Uninsured/Underinsured Motorist (UM/UIM): This coverage is a lifesaver in Florida, where many drivers are uninsured or underinsured. If one of them hits you, your UM/UIM coverage pays for your medical bills and lost wages. Given Orlando’s high number of visitors, this coverage is a smart financial decision.

- Medical Payments (MedPay): MedPay helps cover medical expenses for you and your passengers, regardless of fault. It acts as a secondary coverage to PIP, covering costs beyond PIP’s limits or for services PIP doesn’t cover.

Choosing these additional coverages is about smart risk management. It’s about having a safety net that protects not just your car, but your financial stability in the face of an unpredictable event.

How to Find Affordable Car Insurance in Orlando

Finding affordable orlando fl auto insurance is possible, even with Orlando’s higher-than-average rates. Many strategies and discounts can help reduce your premium without sacrificing protection. Our goal is to help you get the best value. For more tips, see our Cheap Auto Insurance Orlando FL guide.

Opening Up Common Car Insurance Discounts

Insurers offer many discounts, and you may qualify for several. Always ask your agent about what’s available. Here are the most common ones:

- Multi-Policy Discount (Bundling): One of the biggest money-savers. Bundling policies like auto and home insurance with the same carrier can lead to significant discounts, with some customers saving over 25%.

- Multi-Car Discount: If you insure more than one vehicle on the same policy, you’ll typically qualify for a discount.

- Good Student Discount: If you have a young driver on your policy who maintains a B average or better, they may be eligible for a discount.

- Safe Driver Discount: A clean driving record (no accidents or violations for 3-5 years) is rewarded with lower rates. Telematics programs that track safe driving habits can also provide discounts.

- Anti-Theft Device Discount: If your vehicle is equipped with anti-theft features (alarms, tracking devices), your insurer may offer a discount.

- Pay-in-Full Discount: If you can pay your entire premium upfront, many insurers will give you a discount compared to paying monthly.

- Defensive Driving Course Discount: Completing an approved defensive driving course can earn you a discount, especially for younger drivers or those with points on their license.

Don’t leave money on the table! Always inquire about every discount you might qualify for.

Smart Ways to Get a Cheaper orlando fl auto insurance Premium

Beyond discounts, proactive steps can lower your insurance costs.

- Comparing Quotes: This is the golden rule. Rates vary significantly between carriers for the same coverage. Comparing quotes from multiple providers is the most effective way to find the best deal. Our Auto Insurance Quote Orlando FL Guide can help.

- Raising Your Deductible: If you have an emergency fund, consider raising your collision and comprehensive deductibles. A higher deductible lowers your premium, but you’ll pay more out-of-pocket for a claim. Ensure you can afford the deductible.

- Maintaining a Good Credit Score: As we discussed, your credit-based insurance score can impact your rates in Florida. A strong credit score often leads to lower premiums.

- Choosing the Right Vehicle: When buying a new car, research its insurance costs. Vehicles with high safety ratings and lower theft rates tend to be cheaper to insure.

- Reviewing Your Policy Annually: Life changes, and so do insurance rates. Review your coverage needs and shop around annually to ensure you’re still getting the best value.

The Advantage of Using an Independent Agent for orlando fl auto insurance

In a crowded market like Orlando, finding the right car insurance is challenging. An independent agent, like Select Insurance Group, is your secret weapon.

- Expert Guidance: We understand Florida’s insurance laws and Orlando’s unique driving environment. We explain complex terms simply and help you find coverage that truly protects you.

- Access to Multiple Carriers: As independent agents, we partner with over 40 carriers. We shop on your behalf, comparing rates and options from many providers to find the best fit for your needs and budget, ensuring you get the best deal.

- Personalized Service: We take time to understand your unique situation to craft a personalized insurance solution, not a generic policy.

- One-Stop Shopping: We do the legwork for you, saving you the time and effort of getting multiple quotes yourself.

- Unbiased Advice: We work for you, not an insurance company, so our advice is unbiased. We focus on finding the right coverage at the right price, prioritizing your interests.

In short, using an independent agent means you get an expert advocate in your corner, ensuring you find secure, affordable orlando fl auto insurance without the hassle.

Frequently Asked Questions about Orlando Auto Insurance

Why is car insurance so expensive in Florida?

Yes, Florida car insurance is often more expensive than in other states due to several factors:

- No-Fault System Costs: The no-fault system, while designed to speed up medical care, can lead to higher costs for insurers due to automatic PIP benefit payouts.

- High Population Density and Tourism: Florida’s high population density and Orlando’s millions of annual tourists mean more cars, more accidents, and higher premiums.

- Frequent Severe Weather: Florida’s frequent hurricanes, tropical storms, and thunderstorms cause significant vehicle damage, leading to more comprehensive claims.

- High Litigation Rates: Florida has high rates of insurance litigation, increasing costs for insurers, which are then passed on to policyholders.

- Insurance Fraud: Insurance fraud, especially involving PIP claims, also contributes to higher costs for all drivers.

All these elements combine to make Florida one of the more expensive states for car insurance.

Do I need Bodily Injury Liability coverage in Orlando?

While Florida law does not legally mandate Bodily Injury Liability (BIL) coverage, we strongly recommend it.

Here’s why:

- Protecting Your Personal Assets: If you’re at fault in an accident that injures others, BIL protects your personal assets from lawsuits that could otherwise lead to wage garnishment, liens on your home, or loss of savings.

- Covering Injuries to Others: BIL pays for the medical costs, lost wages, and pain and suffering of others when you are legally responsible for their injuries.

- Peace of Mind: Knowing you’re adequately protected against potentially devastating financial claims offers invaluable peace of mind.

Think of it this way: PIP protects you and your immediate medical needs. PDL protects other people’s property. BIL protects you from lawsuits if you injure other people. It’s a critical component of responsible driving and asset protection.

How much can I save by bundling my auto and home insurance?

Bundling auto and home insurance with the same carrier is one of the most effective ways to save money.

The savings vary by carrier and location, but it’s common to save 10% to 25% or more on combined premiums. Some research shows new customers save over 25% on average nationwide.

Besides savings, bundling offers other advantages:

- Convenience: Managing all your policies with one provider simplifies your insurance life. You’ll have one agent and one bill for all your insurance needs.

- Multi-Policy Discount: This is the specific discount applied when you bundle. Insurers offer it because customers who bundle tend to be more loyal.

When we work with our clients, bundling is one of the first strategies we explore to help them maximize their savings without compromising on coverage.

Conclusion: Your Next Step to Secure, Affordable Coverage

Navigating Orlando’s busy roads and Florida’s unique insurance landscape requires more than just meeting the minimum legal requirements. It demands a thoughtful approach to your orlando fl auto insurance—one that balances comprehensive protection with affordability. We’ve explored the legal necessities, decoded the factors influencing your costs, and highlighted the crucial coverages that truly safeguard your future.

The key takeaways are clear:

- Understand Florida’s minimum PIP and PDL requirements, but don’t stop there.

- Recognize the impact of Florida’s no-fault system and the importance of BIL and UM/UIM.

- Be aware of the many factors influencing your premium, from your driving record to your credit score.

- Actively seek out discounts and smart strategies to lower your costs.

- Most importantly, compare quotes from multiple carriers to ensure you’re getting the best value.

At Select Insurance Group, we believe in empowering Orlando drivers with knowledge and choice. With over 30 years of experience, we’ve helped countless individuals and families find the perfect balance of coverage and cost. We work with over 40 top-rated carriers, doing the shopping for you to ensure you receive competitive rates and superior customer service.

Don’t settle for guesswork or the first quote you receive. Let us help you find the orlando fl auto insurance that truly fits your life. Contact our West Orlando agency for a personalized quote today and experience the Select Insurance Group difference. We’re here to make your journey on Orlando’s roads as smooth and secure as possible.