Why Finding Affordable Motorcycle Insurance Matters

Finding the cheapest motorcycle insurance is within reach when you know where to look. Here’s how to get the best deal:

Top Ways to Find Cheap Motorcycle Insurance:

- Compare quotes from multiple top providers

- Bundle policies with your auto or homeowners insurance to save 5-25%

- Complete a safety course to earn immediate discounts

- Choose the right bike—cruisers and standard bikes cost less to insure than sport bikes

- Shop around annually—rates can vary dramatically by provider

Every rider wants solid protection that doesn’t drain their bank account. The good news is that motorcycle insurance can start as low as $75 per year or $7 per month with the right approach. But not all “cheap” insurance is created equal. The cheapest policy might leave you exposed when you need coverage most. The goal is finding affordable insurance that actually protects you, balancing low premiums with meaningful coverage.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over three decades in the insurance industry, I’ve helped thousands of riders across the Southeast find the cheapest motorcycle insurance that still delivers real protection. Whether you’re shopping for your first bike or your fifth, understanding what drives your rate is the first step to saving money.

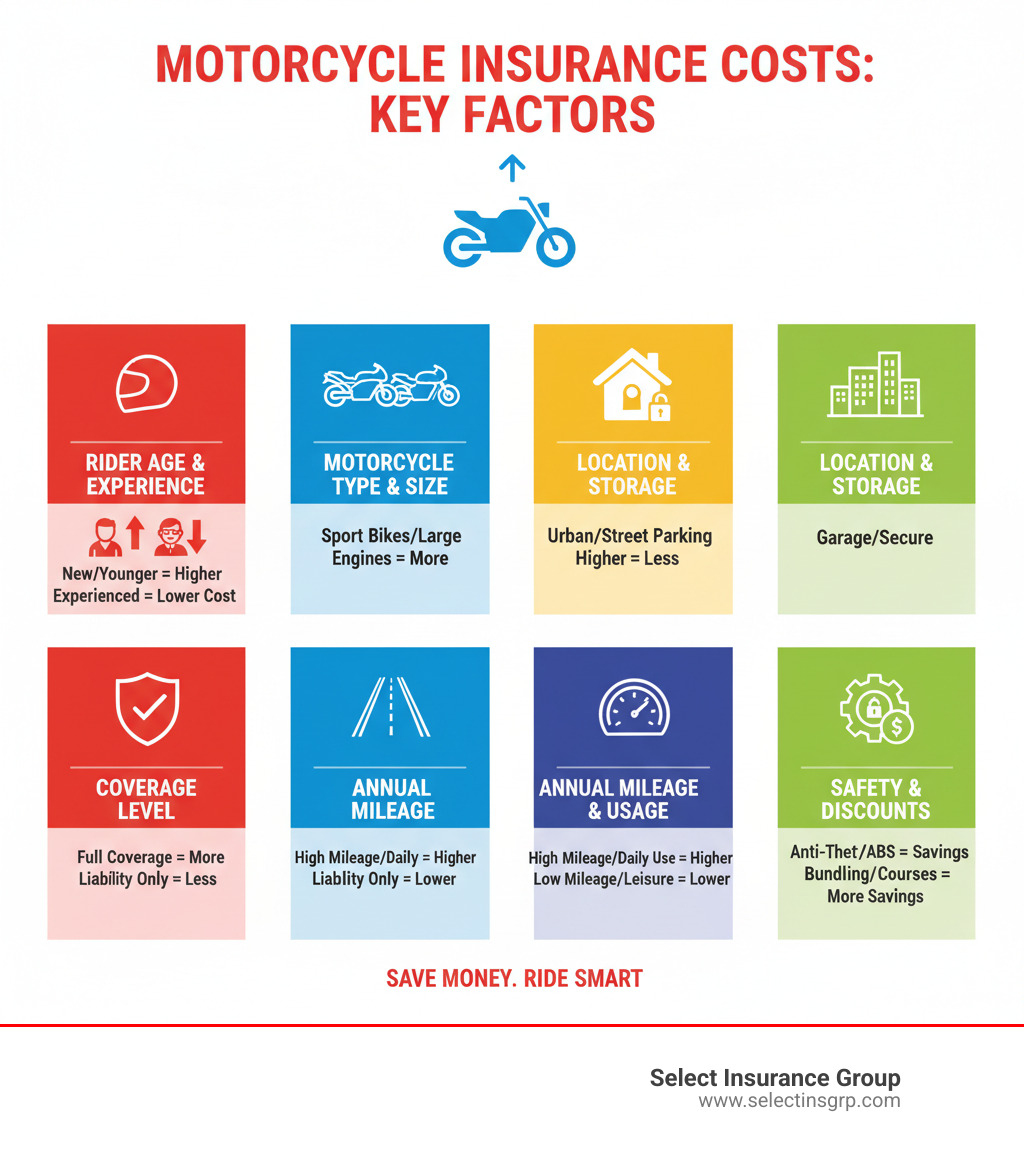

Understanding What Drives Your Motorcycle Insurance Rate

Let’s talk numbers. The national average cost for full coverage motorcycle insurance is around $571 per year (about $48 per month), while liability-only coverage can be as low as $9-$14 per month. However, these are just averages. Your actual premium depends on your specific risk profile.

Motorcycle insurance is often cheaper than car insurance because bikes typically cause less damage to others in an at-fault accident, keeping liability costs down. While motorcycle crashes are statistically more dangerous for the rider, there are fewer of them overall compared to car accidents. The Insurance Information Institute provides detailed motorcycle crash statistics if you want to dig deeper.

So what makes your rate tick? Let’s break down the key factors.

Your Rider Profile

Insurers look at you first—your age, experience, and driving history.

- Age and experience: Young riders under 25 face the highest premiums, sometimes over $1,000 annually, due to higher statistical risk. Rates typically decrease with age and experience, with senior riders often getting the best prices.

- Driving record: A clean record is your best asset for low premiums. Accidents, tickets, and violations signal higher risk and will increase your rate.

- Credit score: In most states, a good credit history can lower your premiums, as insurers correlate financial responsibility with safer riding. An insurance quote won’t affect your credit score.

- Safety course: Completing an approved safety course from an organization like the Motorcycle Safety Foundation demonstrates your commitment to safety and usually earns you a discount.

The Type of Motorcycle You Ride

Your bike is a huge factor in determining your rate.

- Type of bike: Sport bikes are significantly more expensive to insure than cruisers, touring bikes, or standard models. Their high horsepower and association with speed lead to higher perceived risk.

- Engine size and horsepower: More power generally means a higher premium. A 1200cc engine will cost more to insure than a 600cc one.

- Bike value and repair costs: The more your bike is worth, the more it costs to insure for comprehensive and collision. Rare or specialized parts also drive up repair costs and, consequently, your rate.

- Theft rates: If your bike’s model is frequently stolen, your comprehensive coverage will cost more.

- Custom parts: Accessories and modifications increase your bike’s value and your insurance cost. Ensure you have adequate accessory coverage to protect your investment.

Your Location and How You Use Your Bike

Where and how you ride also influences your premium.

- Location: Your ZIP code matters. Urban areas with more traffic, accidents, and theft have higher rates than rural areas. State-level laws and regulations also cause significant rate variations.

- Annual mileage: The more you ride, the higher your exposure to risk. A daily commuter will likely pay more than a weekend pleasure rider.

- Storage: Storing your motorcycle in a locked garage reduces the risk of theft and vandalism, which can lower your premium compared to parking it on the street.

Your Step-by-Step Guide to Getting the Cheapest Motorcycle Insurance

Finding the cheapest motorcycle insurance is about being strategic, not cutting corners. The goal is to find the perfect balance between price and peace of mind—genuine value that delivers solid protection at a price that fits your budget.

Step 1: Compare Quotes from Multiple Providers

The same coverage can cost hundreds of dollars more with one insurer versus another, so shopping around is essential.

Working with an independent agent is the most efficient approach. At Select Insurance Group, we partner with over 40 carriers. We gather your information once and compare quotes across dozens of providers to find your best options. Since we aren’t tied to one company, our only goal is to find the policy that serves you best.

Before gathering quotes, have your motorcycle’s VIN, year, make, model, and your driver’s license information ready. Also, be sure to check the financial strength of any insurer you consider. A cheap policy is worthless if the company can’t pay claims. You can check an insurer’s financial rating through agencies like A.M. Best; look for ratings of ‘A’ or higher.

Step 2: Maximize All Available Discounts

Most riders qualify for multiple discounts but don’t receive them because they don’t ask. This step can slash your premium by 20% or more. Ask your agent about:

- Multi-policy bundling: Save 5-25% by bundling with your auto or home insurance.

- Homeowner discount: Some insurers offer a discount just for owning a home.

- Riding organization affiliation: Members of groups like the Harley Owners Group may qualify.

- Safety course completion: A completed course from the Motorcycle Safety Foundation or similar programs earns a discount.

- Good driver/claim-free: A clean record and no recent claims can lead to significant savings.

- Experienced rider: Discounts are often available for riders with many years of experience.

- Anti-theft devices: Alarms, GPS trackers, and other security features can lower your comprehensive costs.

- Multi-cycle discount: Insuring more than one motorcycle with the same company.

- Payment discounts: Paying your premium in full or setting up automatic payments can save you money.

Step 3: Customize Your Coverage for the Best Rate

Fine-tune your coverage to find the sweet spot between protection and price.

- Adjust your deductible: A higher deductible (e.g., $1,000 vs. $500) lowers your premium. Just be sure you can comfortably afford to pay it out-of-pocket if you file a claim. To better understand what are deductibles?, this resource breaks it down clearly.

- Review coverage limits: For an older, low-value bike, you might consider dropping comprehensive and collision coverage. However, never skimp on liability coverage, which protects your assets if you cause an accident.

- Understand valuation: Actual cash value (ACV) is the most affordable option, paying your bike’s depreciated value. Agreed value is for custom/vintage bikes, and replacement cost coverage, for new bikes, pays for a brand-new replacement. Choose the one that best fits your bike and budget.

Decoding Your Policy: Liability-Only vs. Full Coverage

Understanding different types of motorcycle insurance is key to balancing cost and protection. When shopping for the cheapest motorcycle insurance, knowing what you’re buying makes all the difference.

What is Liability-Only Insurance?

Liability-only insurance is the minimum coverage required by law in most states. It protects others on the road, not you or your bike. It includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for others if you cause an accident.

- Property Damage Liability: Pays to repair or replace property you damage, like another vehicle or a fence.

Every state sets minimum liability limits (e.g., 25/50/25). This coverage does not pay for damage to your motorcycle or your own medical bills. It’s best suited for riders with older, low-value bikes, but we always recommend carrying limits higher than the state minimum to protect your personal assets.

What is Full Coverage Insurance?

“Full coverage” is shorthand for a policy that includes liability plus collision and comprehensive coverage. Lenders require it for financed bikes.

- Collision Coverage: Pays for damage to your motorcycle from a collision with another vehicle or object, or if your bike tips over, regardless of fault.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, fire, hail, or hitting an animal.

Here’s a straightforward comparison:

| Feature | Liability-Only Insurance | Full Coverage Insurance |

|---|---|---|

| Covers Others’ Injuries | Yes | Yes |

| Covers Others’ Property | Yes | Yes |

| Covers Your Bike Damage | No | Yes (Collision & Comprehensive) |

| Covers Your Injuries | No | No (Unless optional MedPay/PIP added) |

| Theft Protection | No | Yes (Comprehensive) |

| Weather/Vandalism | No | Yes (Comprehensive) |

| Cost | Generally Lower | Generally Higher |

| Required by Lenders | No | Yes |

Full coverage is essential for protecting your investment, especially for new or expensive motorcycles.

Popular Optional Coverages

These add-ons provide valuable financial protection and peace of mind:

- Uninsured/Underinsured Motorist (UM/UIM): We can’t stress this enough. It covers your medical bills and damages if you’re hit by a driver with no insurance or not enough insurance. It’s a crucial protection.

- Medical Payments (MedPay): Covers your and your passengers’ medical expenses, regardless of who is at fault, providing immediate funds for hospital bills.

- Accessory Coverage: Protects your investment in custom parts, gear, and electronics. Standard policies include a small amount, but you can increase the limit for extensive customizations.

- Roadside Assistance: Covers towing, fuel delivery, and other emergency services for a few dollars a month. Invaluable when you’re stranded.

- Trip Interruption: Reimburses you for lodging and transportation if your bike breaks down far from home on a trip.

Navigating State-Specific Insurance Requirements

Understanding your state’s motorcycle insurance laws is about more than just staying legal—it’s about protecting yourself. Requirements vary dramatically across the country, and while most states mandate liability coverage, the minimums are often not enough to protect your assets in a serious accident. For a comprehensive overview, the state-by-state motorcycle laws guide is an excellent resource.

Minimum Requirements in the Southeast

At Select Insurance Group, we specialize in helping riders steer the specific requirements in our region.

- Florida: Uniquely, Florida doesn’t mandate motorcycle insurance but requires proof of financial responsibility. This means you’re personally liable for damages in an at-fault accident. Skipping insurance is a huge financial risk. Learn more on our Florida Motorcycle Insurance page.

- Georgia: Requires liability coverage. We can help you find a policy that meets state law and provides adequate protection. See our Georgia Motorcycle Insurance page for details.

- North Carolina: Mandates liability insurance, with serious penalties for non-compliance. Visit our North Carolina Motorcycle Insurance page to explore options.

- South Carolina: Requires 25/50/25 liability coverage ($25k bodily injury per person, $50k per accident, $25k property damage). These limits can be exhausted quickly in a serious accident. Learn more on our South Carolina Motorcycle Insurance page.

- Virginia: As of July 1, 2024, insurance is mandatory. Minimums are currently 30/60/20 but will increase to 50/100/25 on January 1, 2025. Ensure your policy is compliant. Our Virginia Motorcycle Insurance guide has the details.

Tips for Young Riders and Sport Bike Owners

If you’re in a high-risk category, you’ve likely seen high quotes. Here are key strategies to find the cheapest motorcycle insurance:

- Take a safety course: This is the most effective way to lower your rate and become a safer rider.

- Start with a less powerful bike: Choosing a standard or cruiser model over a high-horsepower sport bike can save you thousands annually. You can upgrade later once you’ve built a safe riding history.

- Shop extensively: Rates for high-risk profiles can vary by thousands between carriers. An independent agent can compare dozens of quotes to find the most competitive option for you.

- Keep your record clean: Avoiding tickets and accidents is critical to lowering your premiums over time.

Frequently Asked Questions about Cheap Motorcycle Insurance

We’ve helped riders for decades, and a few questions always come up when searching for affordable coverage.

Is motorcycle insurance cheaper than car insurance?

Yes, in most cases. The average full coverage motorcycle policy costs around $519-$571 per year, while car insurance averages about $2,014. This is because motorcycles typically cause less property damage in an accident, and overall repair costs are often lower. However, this isn’t a universal rule. A young rider on a high-performance sport bike could easily pay more for motorcycle insurance than for car insurance.

Should I cancel my motorcycle insurance in the winter?

We almost always advise against it. Your bike still faces risks like theft, fire, and vandalism while in storage, all of which are covered by your comprehensive policy. Canceling and restarting your policy can also cause you to lose continuous coverage and loyalty discounts, potentially leading to higher rates in the spring. Furthermore, if you financed your bike, your lender will require year-round coverage.

How much coverage do I really need?

This is the most important question. State minimums are often dangerously low and may not protect your assets in a serious lawsuit. The right amount of coverage depends on:

- Your bike’s value: A new or expensive bike needs full coverage (comprehensive and collision) to protect your investment. An older, low-value bike might only need liability.

- Your personal assets: The more you have to protect (a home, savings), the higher your liability limits should be. We recommend the highest liability coverage you can comfortably afford.

- How you ride: Daily commuters and long-distance tourers have different needs than weekend riders. Consider add-ons like uninsured/underinsured motorist coverage (which we strongly recommend), medical payments, and roadside assistance.

The goal is to find the cheapest motorcycle insurance that still provides real protection for your bike and your financial future.

Conclusion

Finding the cheapest motorcycle insurance isn’t about settling for less; it’s about being a smart shopper. By comparing quotes, asking for every available discount, and customizing your coverage, you can find a policy that fits your budget without sacrificing protection.

We’ve covered why your rider profile, bike type, and location matter. We’ve also highlighted the importance of understanding your state’s laws, whether you’re in Florida, Georgia, North Carolina, South Carolina, or Virginia. State minimums are a starting point, not a destination. True peace of mind comes from having coverage that genuinely protects your assets.

At Select Insurance Group, we’re riders and neighbors who care about protecting what matters to you. With access to over 40 carriers, we do the heavy lifting to find you the best rates. For over 30 years, we’ve helped riders across the Southeast get the right policy, giving them confidence every time they start their engines.

The road ahead should be about the ride, not about insurance worries. Ready to find affordable insurance that actually protects you? Let’s talk. For our Virginia riders specifically, you can get expert help finding the best motorcycle insurance in Virginia by reaching out to us. We’ll find a policy that fits your life and your budget, so you can answer the call of the open road with complete confidence.