Why Getting Truck Insurance Quotes Online Matters

Truck insurance quotes online have transformed how truckers secure coverage. Instead of spending days calling agents, you can now compare options from numerous carriers in minutes—all from your phone, tablet, or computer.

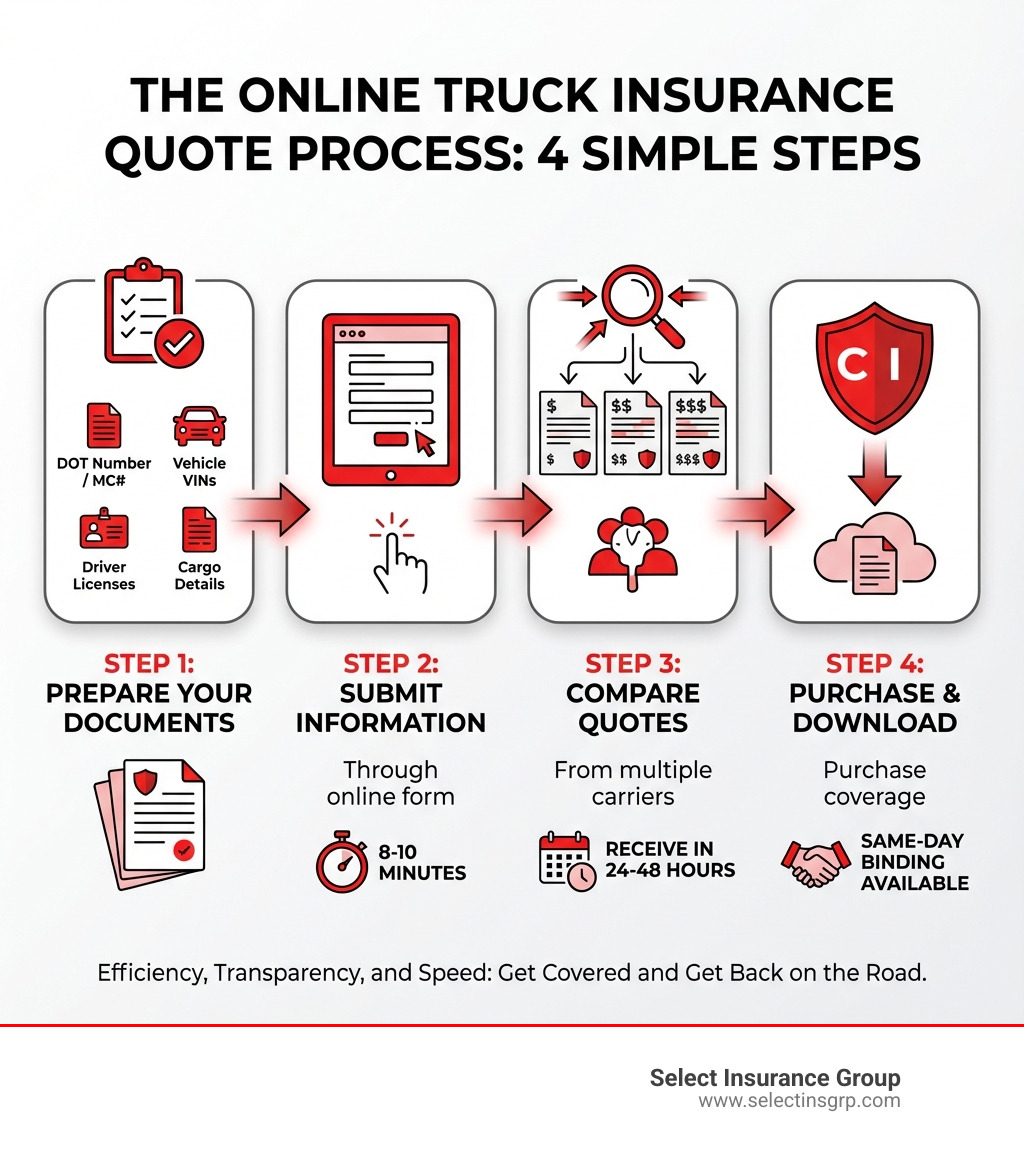

Here’s how to get truck insurance quotes online in 4 simple steps:

- Prepare your information – Gather your DOT/MC numbers, VINs, driver details, and cargo types

- Submit your application – Fill out an online form (typically takes 8-10 minutes)

- Compare your quotes – Review offers from multiple carriers within 48 hours

- Purchase coverage – Finalize your policy and download proof of insurance immediately

This digital shift puts you in control. You can shop anytime, compare real numbers side-by-side, and make informed decisions without pressure. For trucking businesses, online quoting means more transparency, a faster turnaround, and the power to find coverage that fits your operation.

The old way meant taking time off the road and playing phone tag. The new way means efficiency, choice, and confidence.

I’m D.J. Hearsey, founder of Select Insurance Group with over three decades of experience helping truckers across the Southeast secure affordable coverage. We’ve helped thousands of owner-operators and motor carriers get truck insurance quotes online quickly and find policies that protect their livelihoods without breaking the bank.

Quick look at Truck insurance quotes online:

Preparing for Your Quote: What You’ll Need

Getting accurate truck insurance quotes online requires complete information. Think of it like preparing your truck for a long haul—you wouldn’t hit the road without checking everything first. Gathering your information upfront streamlines the entire process, saving you time and frustration.

What Information Do I Need for Truck Insurance Quotes Online?

To get accurate truck insurance quotes online, you’ll need to provide a snapshot of your business, vehicles, and drivers. Here’s a checklist of what you’ll need:

-

Business Details:

- Legal Company Name and DBA (if any)

- Business Structure (Sole Proprietorship, LLC, etc.)

- Year Business Established

- Physical Business Address (should match your DOT filing)

- Tax ID (EIN)

- USDOT and MC Numbers

- Working History (number of trucks/trailers operated for the past few years)

- Parking Information (location and security details)

-

Vehicle Information:

- Vehicle Identification Number (VIN) for each truck

- Year, Make, and Model

- Gross Vehicle Weight (GVW)

- Stated Value (the actual cash value of your truck and trailer)

- Trailer Details (number, type, and stated value; specify if you use non-owned trailers)

-

Driver Information:

- Full Legal Name, Date of Birth, and Driver’s License Number for all drivers

- CDL Year Originally Issued and Years of Experience

- List of any Moving Violations and Accidents in the past 3-5 years

-

Operational Data:

- Radius of Operation (local, regional, or long-haul)

- Type of Freight Hauled (be specific; e.g., “cereal” instead of “general freight” to ensure accurate risk assessment)

- Desired Coverages (Auto Liability, Physical Damage, Cargo, etc.)

-

Historical Documents:

- Loss Run Reports (5-year claims history from previous insurers)

- Motor Vehicle Reports (MVRs) for all drivers

- IFTA Reports (most recent four quarters)

- Certificates of Insurance (from the last five years)

Having this information organized will make your online quote experience much smoother and ensure the quotes you receive are as accurate as possible.

The Step-by-Step Process for Getting Truck Insurance Quotes Online

Gone are the days of endless phone calls and waiting games. Getting truck insurance quotes online is a streamlined process designed to get you covered faster. Our online portals are always open, whether you’re an early bird or a night owl.

From Start to Finish: Navigating the Online Application

Here’s how we guide you through obtaining your truck insurance quotes online:

-

Step 1: Complete the Online Form

The journey begins with a detailed online application. This intuitive form asks for your business, vehicle, driver, and operational data. Completing this step can take as little as 8-10 minutes and introduces your business to potential insurers. -

Step 2: Review Automated Quotes (Initial Offers)

Once you submit your information, our system can often generate immediate, automated quotes. These initial offers give you a ballpark idea of what you might pay. You get to see options from multiple providers quickly and without obligation. -

Step 3: Connect with a Licensed Specialist

While automated quotes are fast, commercial truck insurance is complex. After reviewing initial offers, you’ll connect with one of our licensed truck insurance specialists. This is where our 30+ years of experience benefits you. We’ll review your needs, clarify details, and help you understand the nuances of each policy. This conversation ensures you get the right quote and meet crucial Federal Motor Carrier Safety Administration (FMCSA) requirements for insurance filings. -

Step 4: Finalize Coverage and Get Proof of Insurance

Once you’ve chosen the best policy, we’ll help you finalize the paperwork and bind coverage. You can often get coverage immediately, with insurance filings usually completed within 48 hours. This means you can receive your certificate of insurance electronically on the same day and get back on the road without delay.

The entire process is designed for efficiency. While timing can vary, we strive to provide a seamless experience, getting you from “quote” to “covered” in record time.

Decoding Your Quote: Coverage and Cost Factors

Understanding your truck insurance quotes online means looking beyond the final price. It requires diving into policy components, knowing the difference between liability and physical damage, and recognizing how regulations shape your coverage. Your quote is a reflection of a risk assessment customized to your operation.

Common Coverage Types for Truckers

When you get truck insurance quotes online, you’ll see a range of options. Here are the most common types:

-

Primary Liability: The core of your policy, this covers bodily injury and property damage to others if you’re at fault in an accident. It’s a legal requirement for most trucking operations. Learn more on our Truck Liability Coverage page.

-

Physical Damage: This protects your truck and trailer from damage due to collision, fire, theft, or vandalism. It covers repair or replacement costs. Some policies even include extras like glass breakage and downtime coverage.

-

Motor Truck Cargo: This protects the freight you’re hauling from loss or damage. The type of cargo significantly impacts this coverage. Find out more on our page for Cargo Insurance for Truckers.

-

General Liability: This protects your business from claims not directly related to operating your vehicle, such as a slip-and-fall at your office. Bundling it with primary liability can lead to savings.

-

Non-Trucking Liability (Bobtail): Crucial for owner-operators leased to a motor carrier, this provides liability coverage when the truck is used for non-business or personal purposes (NTL) or driven without a trailer for a business reason (Bobtail).

-

Trailer Interchange: This protects a non-owned trailer in your possession under a written interchange agreement.

Other important coverages include Workers’ Compensation, Umbrella/Excess Liability, and Cyber Insurance.

Key Factors That Determine Your Insurance Rate

The cost of your truck insurance quotes online is calculated based on many risk factors. Here’s what underwriters consider:

- Driving Records: Perhaps the most significant factor. Clean MVRs for all drivers lead to better rates, while a history of accidents or violations will increase premiums.

- Vehicle Type and Age: The truck’s size, weight, and age play a role. Larger or more specialized vehicles often have higher premiums.

- Cargo Type: What you haul matters. High-value goods or hazardous materials carry higher risks and, consequently, higher cargo insurance premiums.

- Operating Radius: Long-haul operations are generally riskier than local routes. Interstate operations also trigger federal filing requirements.

- USDOT Authority History: Your regulatory compliance and safety record are closely scrutinized. A history of violations can lead to higher premiums.

- Coverage Limits and Deductibles: Higher liability limits increase your premium. A lower deductible also results in a higher premium.

- Business Experience and Loss History: New businesses or those with a history of claims will typically pay more than established businesses with a clean record.

- Location: Your primary garaging location and states of operation influence rates due to varying regulations and local risks.

- Safety Programs and Technology: Implementing safety programs, driver training, and using telematics can sometimes lead to discounts.

For a general idea, average monthly costs for for-hire truck insurance can range from $750 to over $950, but this is just an average. Your specific costs will depend on the factors above. You can find more information on our Average Truck Insurance Cost page.

Comparing Offers and Getting the Best Rates

Receiving multiple truck insurance quotes online is just the first step. The real art lies in comparing them effectively to secure the best rates without compromising on essential coverage. It’s about being a savvy shopper, not just a quick one.

How to Compare Truck Insurance Quotes Online

When you have a few truck insurance quotes online, don’t just pick the cheapest one. A lower price might mean you’re underinsured. Here’s our advice for an apples-to-apples comparison:

- Check for Identical Coverage Limits: Ensure liability, cargo, and physical damage limits are the same across all quotes.

- Compare Deductibles: Make sure deductibles are consistent or adjusted to your preferred risk tolerance. A higher deductible lowers your premium but increases your out-of-pocket cost on a claim.

- Review Policy Exclusions: Every policy has exclusions. Understand what is and isn’t covered.

- Assess Carrier Ratings (A.M. Best): Look beyond price to the insurer’s financial strength. A strong rating, such as ‘A’ (Excellent) or better, indicates the company’s ability to pay claims.

- Look for Value-Added Services: Some insurers offer more than just coverage, like a 24/7 claims hotline or roadside assistance. These can make a big difference.

An independent agent like us can be invaluable here. We work with over 40 carriers, allowing us to compare options on your behalf to find comprehensive coverage at a competitive price.

Tips for Lowering Your Truck Insurance Premiums

Here are some proven strategies to help you get the best rates on your truck insurance quotes online:

- Bundle Policies: Inquire about bundling other business policies, like general liability, which can often lead to savings.

- Pay in Full: Paying your annual premium upfront can often result in a discount.

- Implement Safety Programs: Proactive safety measures, including driver training and regular vehicle maintenance, can reduce your risk profile.

- Hire Experienced and Responsible Drivers: Drivers with clean records and more experience are seen as lower risk.

- Use Telematics and ELDs: Technology can be your friend! Using telematics can lead to significant savings. These programs leverage driving data to reward safe operations.

- Maintain a Good Driving Record: A clean loss history over the past three years can lead to lower premiums.

- Increase Your Deductibles: If you have a healthy emergency fund, opting for a higher deductible can lower your premium.

Trucking accidents are a serious concern. The stats show they are a major problem. By actively working to prevent accidents and demonstrating a commitment to safety, you not only protect lives but also positively impact your insurance costs.

Special Considerations and Common Mistakes

While getting truck insurance quotes online offers convenience, it’s not a one-size-fits-all solution. Different trucking operations have distinct needs, and overlooking these specifics can lead to inadequate coverage or unnecessary costs.

Insurance Needs: Owner-Operators vs. Motor Carriers

Your business type profoundly impacts your insurance requirements. What works for one operation may not be sufficient for another.

- Owner-Operators with Own Authority: If you operate under your own DOT/MC authority, you are responsible for securing all primary coverages, including primary liability, physical damage, and motor truck cargo insurance.

- Leased Owner-Operators: If you’re leased onto a motor carrier, they usually provide primary liability while you’re under dispatch. You’ll still need your own policy for physical damage and non-trucking or bobtail liability to cover you when not under dispatch. This is where Owner Operator Semi Truck Insurance comes into play.

- Motor Carriers with a Fleet: Businesses with multiple trucks and drivers require comprehensive fleet policies covering all vehicles and drivers, often including workers’ compensation and higher liability limits.

- Private Carriers: If you use trucks to haul your own goods (e.g., a construction company), you’re a private carrier. You still need robust commercial auto insurance to protect against accidents during business operations.

Understanding these distinctions is crucial for getting truck insurance quotes online that fit your business model.

Pitfalls to Avoid When Shopping for Insurance Online

The ease of online quoting can lead to hasty decisions. Here are common mistakes to avoid:

- Providing Inaccurate Information: Incorrect details about your business, vehicles, or drivers can lead to inaccurate quotes or even claim denials. Always double-check your information against official documents like DOT filings and MVRs.

- Choosing the Cheapest Option Without Reviewing Coverage: A low premium could mean inadequate limits, high deductibles, or major exclusions. Always compare policy details, not just the price.

- Not Understanding Your Policy: Insurance policies are legal documents. Take time to understand what’s covered, what’s excluded, and the claims process. If something is unclear, ask your agent.

- Forgetting to List All Drivers or Vehicles: Every driver and vehicle must be listed on your policy. Failing to do so could result in a claim denial.

- Ignoring Carrier Financial Stability: An insurance policy is only as good as the company backing it. Always check the A.M. Best rating of the insurer to ensure they can pay claims.

- Leaving “General Freight” Undefined: Be specific about the commodities you haul. Simply stating “general freight” can lead to higher premiums as underwriters assume the highest risk.

- Not Verifying Physical Addresses: Ensure your physical business address matches your DOT filings to avoid red flags for underwriters.

By being diligent, you can steer the online quoting process successfully and secure the right insurance for your business.

| Feature | Online Quotes | Traditional Methods |

|---|---|---|

| Speed | Very fast; initial quotes in minutes, final in days | Slower; multiple calls, waiting for callbacks |

| Convenience | 24/7 access from anywhere | Limited to business hours, in-person meetings |

| Multiple Options | Easily compare offers from many carriers | May be limited to agent’s represented carriers |

| Initial Interaction | Self-service forms, automated responses | Personal relationship with a single agent |

| Information Gathering | User-driven, often detailed forms | Agent-driven, may require less upfront input from you |

| Personalization | Can be custom with agent follow-up | Strong personal advice and relationship building |

| Paperwork | Digital, electronic signatures | Often paper-based, physical signatures |

| Turnaround for Filings | Can be as fast as 24-48 hours | Varies, often similar to online, but initial process slower |

Frequently Asked Questions about Online Truck Insurance Quotes

When exploring truck insurance quotes online, it’s natural to have questions. We’ve compiled some of the most common inquiries to help you better understand the process and your coverage options.

Does getting a quote online affect my credit score?

No, requesting an insurance quote is typically considered a “soft inquiry,” which does not impact your credit score. Insurers use credit-based insurance scores for rating in some states, but the initial act of quoting does not lower your score. We understand the importance of your credit, and our process is designed to provide you with options without affecting it.

Can I get coverage immediately after receiving an online quote?

Yes, in many cases. After you select a quote and speak with a licensed agent to confirm details, you can often make a payment and have your policy bound the same day. This allows you to receive your certificate of insurance electronically. Federal filings can often be completed within 24-48 hours, getting you covered and compliant as quickly as possible.

What is the difference between bobtail and non-trucking liability insurance?

This is a common question, and the terms are often confused, even though they serve slightly different purposes:

- Bobtail insurance covers your truck when you’re driving without a trailer for a business purpose. Think of it as driving your power unit back to the depot after dropping off a load. Even though you’re not hauling freight, you’re still “bobtailing” for a business reason.

- Non-trucking liability (NTL) insurance covers your truck when you are using it for personal, non-economic purposes. This is common for owner-operators leased to a motor carrier who use their truck for personal errands (like driving to the grocery store or visiting family) when they are not under dispatch.

Both are essential for leased owner-operators to fill coverage gaps when the primary motor carrier’s insurance doesn’t apply.

Conclusion: Drive Forward with Confidence

Getting truck insurance quotes online is a powerful tool that puts control in your hands. This modern approach offers speed, convenience, and transparency, allowing you to secure the vital protection your business needs without unnecessary delays.

By preparing your information, understanding the online process, decoding coverages, and comparing offers wisely, you can make informed decisions that safeguard your livelihood. Avoiding common pitfalls like providing inaccurate information or simply opting for the cheapest option ensures your coverage is robust and reliable.

At Select Insurance Group, we believe in empowering truckers across Florida, the Carolinas, Virginia, and Georgia. With over 30 years of experience, we leverage our partnerships with over 40 carriers to provide you with competitive truck insurance quotes online and the expert guidance you deserve. Our team is here to simplify the complex, answer your questions, and ensure you drive forward with confidence, knowing your business is well-protected.

Ready to experience the ease and efficiency of online truck insurance quotes?