Understanding Virginia’s Motorcycle Insurance Landscape

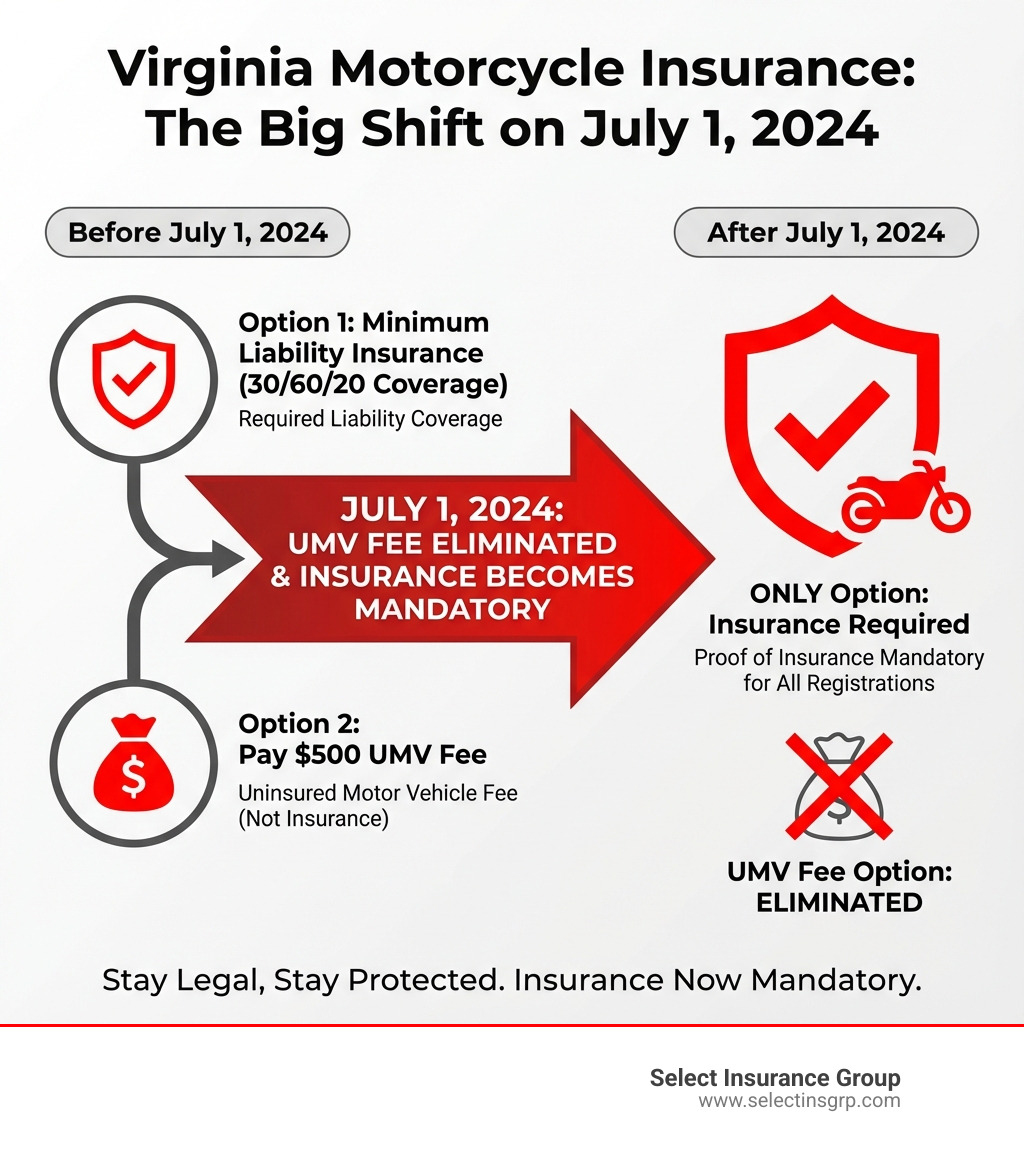

Is motorcycle insurance required in Virginia? The answer depends on when you’re reading this. Virginia has a unique approach to motorcycle insurance that’s changing soon.

Here’s what you need to know right now:

-

Before July 1, 2024: You have two options to legally ride in Virginia:

- Carry minimum liability insurance ($30,000/$60,000/$20,000)

- Pay a $500 Uninsured Motor Vehicle (UMV) fee to the DMV

-

After July 1, 2024: Motorcycle insurance becomes mandatory. The UMV fee option disappears completely under Virginia’s new SB 951 law.

-

Important: Even with the UMV fee option, you’re personally liable for all damages if you cause an accident. Virginia is an “at-fault” state.

Virginia’s insurance laws for motorcycles have always been different from most states. While many states require insurance with no exceptions, Virginia currently allows riders to pay that $500 fee instead. But that flexibility is ending soon, and the financial risks of riding uninsured are significant regardless of which option you choose today.

Whether you’re cruising down the Blue Ridge Parkway or commuting through Richmond, understanding these requirements protects both your wallet and your riding privileges. The consequences of non-compliance include license suspension, registration cancellation, and hefty fines—not to mention personal financial devastation if you’re involved in an accident.

As D.J. Hearsey, founder of Select Insurance Group, I’ve helped thousands of motorcyclists across Virginia steer is motorcycle insurance required in virginia questions while finding coverage that fits their budget and riding style. With Select Insurance Group serving riders throughout the Southeast and access to over 20 carriers, we’ve seen how the right coverage protects riders from financial disaster while keeping premiums affordable.

Simple guide to is motorcycle insurance required in virginia terms:

- Motorcycle Insurance Guide

- How Much Is Motorcycle Insurance: Complete Guide

- Motorcycle Insurance Quote Guide

The Big Change: Virginia’s New Mandatory Insurance Law (Effective July 1, 2024)

Get ready, Virginia riders! A significant shift is coming to motorcycle insurance laws. Starting July 1, 2024, Virginia’s Senate Bill 951 (SB 951) will make motorcycle insurance mandatory for all riders. This means the unique option to pay an Uninsured Motor Vehicle (UMV) fee instead of carrying liability insurance will be completely eliminated.

This legislative change underscores Virginia’s commitment to enhancing road safety and ensuring financial responsibility for all motorists. What does this mean for you? If you’re a motorcyclist in Virginia, you’ll need to secure proper insurance coverage to legally register or renew your motorcycle’s registration. There will be no exceptions.

We understand that navigating these changes can feel a bit like trying to read a map in the dark, but we’re here to shine a light on the path forward. Proactive compliance is key to avoiding legal headaches and ensuring your continued freedom on the open road. As one source notes, this change reflects a broader commitment to ensuring that all motorists, including riders, are adequately protected in the event of an accident. You can learn more about this evolving landscape in Everything you Need to Know about Motorcycle Insurance in Virginia.

What are the legal implications of riding a motorcycle uninsured in Virginia after July 1, 2024?

The implications are straightforward and severe. After July 1, 2024, the option to pay the UMV fee vanishes. This means:

- No UMV Fee Option: You can no longer pay the $500 fee to legally operate your motorcycle without insurance.

- Proof of Insurance Required: You will be required to provide proof of valid motorcycle liability insurance to the Department of Motor Vehicles (DMV) for registration and renewal.

- Registration Denial: Without proof of insurance, you will be unable to register your motorcycle or renew its registration. This means your bike cannot legally be on Virginia roads.

- Increased Enforcement: The DMV enforces these insurance requirements strictly. Riding without proper coverage can result in license suspension, registration cancellation, and significant fines.

- Full Financial Liability: If you are involved in an accident and found at fault without insurance, you will be personally responsible for all damages, including medical bills, property damage, and legal fees, which can quickly amount to hundreds of thousands of dollars. This can lead to liens against your property, wage garnishment, or even bankruptcy.

Riding uninsured after this date isn’t just a legal risk; it’s a monumental financial gamble. We strongly advise all Virginia riders to secure appropriate coverage well before the July 1, 2024 deadline to ensure continuous compliance and peace of mind. To explore your options for comprehensive coverage, visit our page on Virginia Motorcycle Insurance.

So, Is Motorcycle Insurance Required in Virginia Right Now?

As of today, and until the new law takes effect on July 1, 2024, Virginia has a somewhat unique approach to the question: is motorcycle insurance required in Virginia? Unlike most states that strictly mandate insurance, Virginia currently offers two pathways to financial responsibility for motorcyclists.

This current flexibility has often been misunderstood, leading some riders to believe they don’t need insurance at all. However, it’s crucial to remember that Virginia is an “at-fault” state. This means if you cause an accident, you are financially responsible for the damages and injuries you inflict upon others. Our state’s DMV enforces these Insurance requirements strictly, and riding without proper coverage can result in license suspension, registration cancellation, and significant fines.

Let’s break down your current options:

Option 1: Meeting Virginia’s Minimum Liability Requirements

If you choose to carry insurance (and we highly recommend it!), Virginia requires you to meet specific minimum liability limits. These limits are designed to cover the costs if you are found at fault in an accident, compensating the other party for their bodily injuries and property damage.

Currently, the minimum liability coverage for motorcycles (and other vehicles) in Virginia is often referred to as 30/60/20 coverage. Let’s decode that:

- $30,000 for Bodily Injury Liability per person: This is the maximum amount your insurance will pay for injuries to one person in an accident you cause.

- $60,000 for Bodily Injury Liability per accident: This is the maximum amount your insurance will pay for all injuries in an accident you cause, regardless of how many people are hurt.

- $20,000 for Property Damage Liability per accident: This is the maximum amount your insurance will pay for damage to other people’s property (like their vehicle, fence, or house) in an accident you cause.

These minimums are just that – minimums. Medical bills and repair costs can quickly exceed these amounts, especially in serious motorcycle accidents. If damages exceed your policy limits, you could be personally responsible for the difference.

Additionally, if you choose to get insurance, Virginia law currently requires Uninsured/Underinsured Motorist (UM/UIM) coverage that matches these minimum liability limits. This vital coverage protects you if you’re hit by a driver who has no insurance or not enough insurance. Given that over 10% of motorists in Virginia are uninsured, UM/UIM coverage is a critical safeguard. For more details on what’s required, check out our guide on Minimum Motorcycle Insurance Virginia.

Option 2: The Uninsured Motor Vehicle (UMV) Fee Explained

Before July 1, 2024, Virginia offers a unique alternative to purchasing insurance: paying an Uninsured Motor Vehicle (UMV) fee. This fee allows you to register and operate your motorcycle legally without carrying a traditional liability insurance policy.

Here’s how it works:

- The Fee: Currently, the UMV fee is $500. You pay this fee to the Virginia DMV when you register your motorcycle.

- No Actual Insurance Coverage: This is the most crucial point. Paying the UMV fee does not provide any insurance coverage whatsoever. It simply satisfies the state’s financial responsibility requirement to legally register your vehicle.

- Personal Financial Risk: If you choose this option and are involved in an accident where you are at fault, you are 100% personally responsible for all damages and injuries. This means you would have to pay out of pocket for the other party’s medical bills, vehicle repairs, and any legal costs. This could easily lead to severe financial hardship or even bankruptcy.

- Accident Liability: Virginia is an “at-fault” state. Even if you pay the UMV fee, if you cause an accident, you are liable for all expenses. As some experts point out, a single night in the hospital or an ER visit with ambulance bills could easily reach the minimum insurance limits, let alone a serious injury with tests, physical therapy, and time off work.

- Not a Long-Term Solution: Given the high costs associated with accidents and the impending change in law, the UMV fee is a risky and temporary solution. It’s truly a gamble with your financial future.

We strongly advise against relying on the UMV fee as your primary form of financial protection. While it might seem like a cost-saving measure upfront, the potential financial burden of an accident without insurance can be catastrophic.

Penalties and Proof: The Consequences of Riding Uninsured

Whether you’re caught riding uninsured before or after July 1, 2024 (when it becomes fully mandatory), the consequences in Virginia are significant. The state takes financial responsibility very seriously. Beyond the immediate danger of an accident, operating your motorcycle without proper coverage can lead to severe legal and financial penalties that far outweigh the cost of an insurance policy.

If your insurance coverage lapses, or if you’re caught without it, the DMV expects you to take immediate action. This could involve reinsuring your vehicle, or if you no longer wish to operate it, you must deactivate your license plates or permanently surrender them to the DMV. Ignoring these requirements will only lead to more trouble down the road.

What are the penalties for riding a motorcycle without insurance in Virginia?

The penalties for riding a motorcycle without insurance in Virginia are designed to deter non-compliance and can be quite harsh:

- Fines: You can face fines of up to $600 for operating a vehicle without proper insurance.

- Non-Compliance Fee: If you are found to be uninsured without having paid the UMV fee, you will be assessed a $600 non-compliance fee.

- License Suspension: Your driver’s license can be suspended.

- Registration Suspension: Your motorcycle’s registration can be suspended, meaning you cannot legally operate it.

- SR-22 Requirement: To reinstate your driving and registration privileges, you will likely be required to file a Financial Responsibility Insurance Certificate (SR-22) with the DMV for three years. An SR-22 is not insurance itself, but a certification from an insurance company proving you have the minimum required liability coverage. This requirement often leads to higher insurance premiums and limits your choice of insurers. You can learn more about this on our Getting SR22 Insurance Without a Car page.

- Reinstatement Fees: In addition to fines and the SR-22, you will also have to pay reinstatement fees to get your license and registration back.

- Personal Liability for All Damages: This is arguably the most devastating consequence. If you cause an accident while uninsured, you are personally responsible for 100% of the damages, injuries, and legal costs, potentially leading to financial ruin.

These penalties underscore why having proper motorcycle insurance is not just a legal obligation, but a crucial financial safeguard.

How do I prove I have motorcycle insurance in Virginia?

Proving you have motorcycle insurance in Virginia is generally straightforward. You must carry proof of insurance whenever you operate your motorcycle.

Here’s what’s typically accepted:

- Insurance Card (Physical or Digital): Most insurance companies provide an insurance card that includes your policy number, effective dates, and vehicle information. Virginia law allows for digital proof of insurance, so displaying it on your smartphone is acceptable.

- Policy Documents: While less convenient, your actual insurance policy documents can also serve as proof.

When you’re pulled over or involved in an accident, law enforcement officers will ask to see your proof of insurance, along with your driver’s license and registration.

Furthermore, the Virginia DMV has an electronic verification system. Insurance carriers are authorized to conduct business in Virginia and will electronically verify your coverage. This system helps the DMV monitor and verify insurance coverage for registered vehicles, making it essential to maintain continuous coverage. If your policy terminates or cancels, the DMV will be notified, and you could face penalties even if you’re not actively riding.

Beyond the Basics: Optional Coverage for Total Protection

While minimum liability insurance is essential for legal compliance and protecting others, it does very little to protect you and your motorcycle. For true peace of mind and comprehensive financial safety, we always recommend looking beyond the basic requirements. Think of it as adding layers of armor to your riding experience!

Investing in optional coverages transforms your insurance from a mere legal obligation into a robust financial safety net. It means protecting your investment in your motorcycle, safeguarding your health, and ensuring you’re covered for those unexpected twists and turns life can throw your way. For tips on balancing coverage with cost, you might find our Cheapest Motorcycle Insurance Virginia Tips helpful.

What types of optional motorcycle insurance coverage are available in Virginia?

Here are some of the key optional coverages we encourage Virginia motorcyclists to consider:

- Collision Coverage: This covers damages to your motorcycle if you hit another vehicle or object, or if your bike rolls over. It pays for repairs or the actual cash value of your motorcycle, regardless of who is at fault. Without it, repairing your own bike after an accident could come entirely out of your pocket.

- Comprehensive Coverage (Other Than Collision): This is your protection against events other than collisions. It covers things like theft, vandalism, fire, natural disasters (hail, floods, wind), and even hitting an animal. If your prized possession is stolen or damaged by a falling tree, comprehensive coverage steps in.

- Medical Payments (MedPay): This coverage pays for reasonable and necessary medical expenses for you and your passengers, regardless of who is at fault for the accident. It can cover ambulance fees, hospital stays, doctor visits, and even funeral expenses up to your policy limits. This is particularly valuable for motorcyclists, as accidents often result in more severe injuries than car accidents.

- Custom Parts & Equipment (CPE) Coverage: If you’ve invested in making your motorcycle uniquely yours – custom exhaust, specialty paint, upgraded seats, chrome, or performance improvements – standard policies often provide minimal coverage (sometimes as little as $1,000 or less) for aftermarket parts. CPE coverage allows you to increase this limit to protect the full value of your customizations. Be sure to document all your custom parts with receipts and photographs!

- Guest Passenger Liability: While your standard liability coverage might extend to a passenger, some policies offer specific guest passenger liability coverage. This is especially important if you frequently ride with a pillion, ensuring they are adequately covered for injuries if you are at fault in an accident.

- Roadside Assistance: This optional add-on can be a lifesaver if you experience a breakdown, flat tire, or run out of gas. It typically covers towing services, battery jump-starts, and fuel delivery.

- Rental Reimbursement: If your motorcycle is damaged in a covered accident and needs repairs, this coverage helps pay for a rental vehicle so you can still get around.

These additional coverages transform your policy from a basic legal requirement into a comprehensive shield, protecting you, your passengers, and your beloved motorcycle from a wide range of potential financial setbacks.

Frequently Asked Questions about Virginia Motorcycle Insurance

We know you have questions, and we’re here to provide clear, concise answers to help you steer Virginia motorcycle insurance.

How does Virginia’s motorcycle insurance law differ from other states?

Virginia’s motorcycle insurance law has historically stood out primarily because of its Uninsured Motor Vehicle (UMV) fee option. While most states strictly mandate liability insurance for all registered vehicles, Virginia (until July 1, 2024) allows vehicle owners to pay a $500 fee instead of purchasing a policy. This unique “opt-out” feature is rare nationwide.

However, despite this flexibility, it’s crucial to remember that Virginia is an “at-fault” state. This means that the driver (or rider) who causes an accident is legally and financially responsible for all resulting damages and injuries. This contrasts with “no-fault” states, where your own insurance might cover your medical expenses regardless of who caused the accident.

Another unique aspect is Virginia’s contributory negligence rule. This is a strict legal principle where if an injured person contributed to their own injury in any way, they may be prevented from recovering damages from the other party, even if the other party was primarily at fault. This rule makes comprehensive coverage even more important for personal protection.

For example, a neighboring state like Maryland requires minimum liability coverage of $50,000/$100,000/$25,000, which is higher than Virginia’s current minimums. Other states, like New Hampshire, don’t mandate motorcycle insurance at all, while Florida is currently considering a shift from a no-fault system to mandatory liability insurance. These variations highlight why understanding your specific state’s laws is paramount, especially if you travel frequently.

What are the new minimum liability limits starting in 2025?

Virginia is not only making insurance mandatory but also increasing the minimum liability limits to provide greater protection for everyone on the road. These changes will take effect on January 1, 2025.

Here’s a comparison of the current limits, the limits effective until December 31, 2024, and the new limits for 2025:

| Coverage Type | Current Minimum (Pre-2022) | Minimum (Jan. 1, 2022 – Dec. 31, 2024) | New Minimum (On or after Jan. 1, 2025) |

|---|---|---|---|

| Bodily Injury per person | $25,000 | $30,000 | $50,000 |

| Bodily Injury per accident | $50,000 | $60,000 | $100,000 |

| Property Damage per accident | $20,000 | $20,000 | $25,000 |

| Uninsured/Underinsured Motorist | Matches liability | Matches liability | Matches liability |

As you can see, the minimums are increasing significantly. This means that even if you’re covered under the current limits, you’ll need to adjust your policy to meet the new, higher requirements by January 1, 2025. This move aims to ensure that policies are more adequately prepared to cover the rising costs of medical care and vehicle repairs, offering better protection for all parties involved in an accident.

Do I need a special license or to pass a test to ride a motorcycle in VA?

Yes, absolutely! To legally ride a motorcycle in Virginia, you need a Class M driver’s license or a driver’s license with a Class M endorsement. This isn’t something you get automatically with a standard car license.

To obtain your Class M license or endorsement, you generally have two options:

- Pass a Rider Test: This test typically includes both a written knowledge portion and a practical driving skills portion. The written test covers rules of the road specific to motorcycles, safety practices, and general traffic laws. The driving portion assesses your ability to safely operate a motorcycle, including maneuvers like turns, stops, and obstacle avoidance. The Virginia DMV states that all motorcyclists must pass a rider test that includes a written and driving portion, measuring driving ability and knowledge of safety measures.

- Complete a Motorcycle Rider Safety Course: Many riders opt for this route. Completing an approved motorcycle rider safety course can often waive the need to take the DMV’s riding skills test. These courses teach essential riding techniques, safety strategies, and often provide the motorcycle for the practical training. Plus, completing a safety course can sometimes even qualify you for discounts on your motorcycle insurance premiums!

Regardless of which path you choose, ensuring you are properly licensed is a fundamental step to riding legally and safely in Virginia.

Conclusion: Ride with Confidence in the Commonwealth

As we’ve explored, the question of is motorcycle insurance required in Virginia is undergoing a significant change. The impending July 1, 2024 deadline marks the end of Virginia’s unique UMV fee option, ushering in an era where mandatory insurance becomes the standard for all motorcyclists. This change, followed by increased minimum liability limits in 2025, underscores a clear message: financial responsibility on the road is paramount.

For us at Select Insurance Group, this isn’t just about compliance; it’s about empowering you to ride with confidence. Adequate insurance is your financial safeguard against the unforeseen, protecting you from potentially devastating costs related to accidents, injuries, or property damage. It ensures that your passion for riding doesn’t come with undue financial risk.

Navigating these legal changes might seem complex, but that’s where our expertise comes in. With over 30 years of experience and access to more than 20 carriers, we specialize in finding personalized motorcycle insurance solutions that fit your budget and riding lifestyle. We’re here to help you understand your options, meet the new requirements, and ensure you have the comprehensive coverage you deserve.

Don’t wait until the last minute. Be proactive, understand the new laws, and protect your freedom on Virginia’s beautiful roads. Get your personalized Virginia Motorcycle Insurance quote today and ride legal, ride safe, and ride with peace of mind.