Understanding the Non-Driver Designation on Your Car Insurance Policy

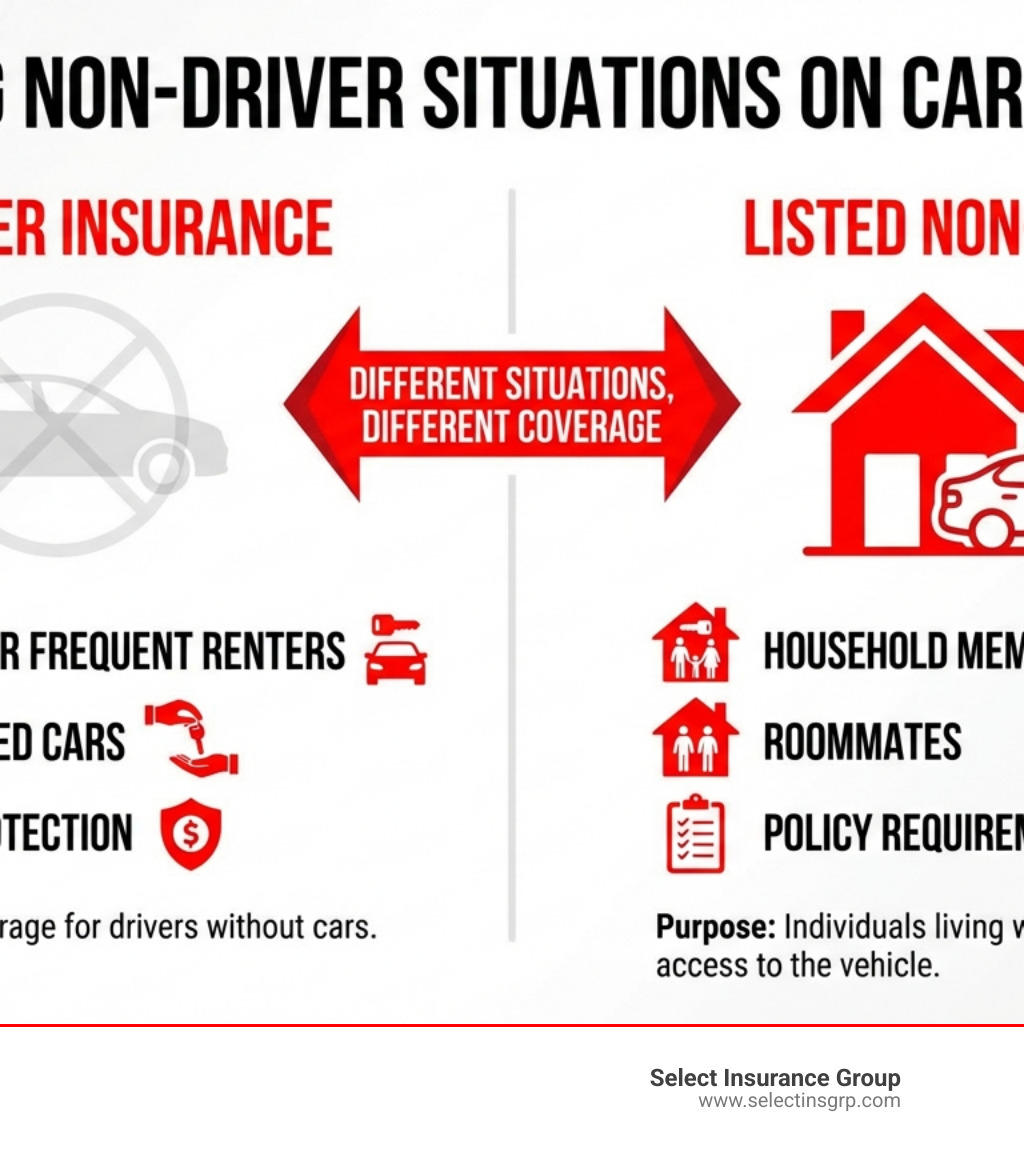

When you hear about a non driver on car insurance, it can refer to a few different scenarios. Understanding the difference is key to having the right coverage. A “non-driver” can mean:

- Non-owner car insurance: A liability policy for people who don’t own a car but drive occasionally.

- Listed non-driver: A household member with access to your car who must be listed on your policy, even if they rarely drive.

- Named driver exclusion: Someone in your household who is specifically excluded from coverage on your vehicle.

Essentially, non-owner insurance is for drivers without cars, while a listed non-driver is someone who lives with you and must be accounted for on your policy. This distinction confuses many people because insurers assess risk based on who has access to a vehicle, not just who drives it.

Getting this wrong can be costly. An unlisted household member causing an accident could lead to a denied claim or policy cancellation. Conversely, buying the wrong coverage when you don’t own a car means you’re either unprotected or overpaying.

I’m D.J. Hearsey, founder of Select Insurance Group. With three decades in the insurance industry, I’ve helped countless clients steer non driver on car insurance situations. Understanding these distinctions protects both your wallet and your peace of mind.

Quick non driver on car insurance definitions:

What is Non-Owner Car Insurance and Who Needs It?

If you drive but don’t own a car, you might need non-owner car insurance. This is a liability policy designed for people who frequently rent or borrow vehicles. Instead of being attached to a specific car, this insurance follows you, the driver.

It provides liability protection for bodily injury and property damage you might cause while driving someone else’s vehicle. This policy acts as secondary coverage, meaning it activates after the primary insurance on the vehicle (the car owner’s or rental company’s policy) is exhausted. If you cause a serious accident and the car owner’s liability limits aren’t enough, your non-owner policy covers the rest.

Another key benefit is maintaining your insurance history. Gaps in coverage can lead to higher premiums when you eventually buy a car. A non-owner policy keeps your record active, showing future insurers you’re a responsible driver.

According to NerdWallet, you should consider a non-owner insurance policy if you do any of the following: rent cars frequently, borrow vehicles regularly, or use car-sharing services.

Who Needs a non driver on car insurance Policy?

Many people can benefit from this type of policy:

- Frequent renters: If you rent cars often, a non-owner policy is usually more cost-effective than buying liability coverage from the rental counter each time.

- City dwellers: Those who use public transport but occasionally rent or borrow a car for errands or trips.

- College students: If a student is away at school without a car but sometimes drives, a non-owner policy can provide coverage.

- People between cars: If you’ve sold your car and haven’t bought a new one, this policy bridges the coverage gap.

- Regular borrowers: If you frequently borrow a car from friends or family, this policy adds a layer of protection beyond the owner’s insurance.

- Car-sharing service users: Services like Zipcar or Turo have basic insurance, but a non-owner policy offers supplemental liability protection.

- Drivers needing an SR-22 filing: If you need to file an SR-22 but don’t own a car, a non-owner policy is often the most affordable way to meet this legal requirement. More info about getting SR22 insurance without a car

What Does a Non-Owner Policy Cover?

A non-owner car insurance policy is centered on liability coverage, protecting you when you cause damage or injuries to others.

- Bodily injury liability: Covers medical expenses and lost wages for others if you’re at fault.

- Property damage liability: Pays for repairs to other people’s property, like their vehicle or a fence.

This coverage is secondary; the car owner’s insurance pays first, and your policy covers any excess costs. More info about getting liability insurance without a car

Optional coverages can often be added:

- Medical payments (MedPay) or Personal Injury Protection (PIP): Helps pay for your and your passengers’ medical expenses, regardless of fault.

- Uninsured/underinsured motorist coverage: Protects you if you’re hit by a driver with little or no insurance.

What are the limitations of non driver on car insurance?

It’s crucial to understand what a non-owner policy doesn’t cover.

The biggest limitation is that it doesn’t cover damage to the car you are driving. As ValuePenguin notes that a non-owner car insurance policy applies to the driver, not the vehicle, it includes no collision or comprehensive coverage. If you damage a borrowed or rented car, you are personally responsible for repairs. For rentals, consider the Collision Damage Waiver (CDW) from the rental company or check your credit card benefits.

Other exclusions include:

- Personal property: Items stolen from or damaged inside the car are not covered.

- Business use: Using a vehicle for commercial purposes like deliveries or ride-sharing is typically excluded.

- Household members’ cars: A non-owner policy is not a substitute for being listed on the policy of a household member whose car you regularly access. You must be added to their policy.

Understanding Listed Drivers vs. Permissive Use

Another common non driver on car insurance scenario involves people who live with you. This isn’t about needing non-owner insurance; it’s about who must be listed on your existing policy.

Insurance companies care about who could drive your car, not just who does. If someone lives in your household, has a license, and has access to your keys, they are seen as a potential risk. This is why insurers require you to list all licensed household members, even if they rarely drive.

This is different from “permissive use,” a clause that extends coverage to someone who borrows your car with your permission on an occasional basis. For example, a friend borrowing your truck for an afternoon is typically covered. However, if that use becomes regular, they are no longer an occasional user. Generally, you don’t need to get additional driver insurance for someone who doesn’t reside with you, but frequency is key. When in doubt, it’s best to ask your insurance provider.

When to Add a Driver to Your Policy

You generally need to add someone to your policy if they live with you and have a license. This includes:

- Spouses and domestic partners living with you.

- Licensed teenagers and adult children living at home.

- Other resident relatives, like a parent or sibling, who live with you.

- Roommates who have regular access to your car.

- Live-in nannies or caregivers who drive your vehicle as part of their duties.

Failing to list these individuals can have severe consequences. If an unlisted household member has an accident, your insurer could deny the claim, cancel your policy, or leave you personally liable for all damages. Learn more about adding a driver to your policy

The Impact of Adding a Driver on Your Premium

Adding a driver to your policy might change your premium, but it’s not always an increase. Insurers calculate rates based on the combined risk of all drivers.

- Driving record: A driver with a clean record may have little impact, while one with tickets or accidents will likely increase your rate.

- Age and experience: Adding a teen driver usually raises rates, but adding an experienced driver with a good record can sometimes lower them.

Other factors like gender and marital status can also play a role. The impact varies, so it’s best to get a specific quote. For context, while it’s a different policy type, a rate analysis by Insurance.com shows the average annual cost of a non-owner car insurance policy is $474, illustrating how individual circumstances affect costs. The only way to know for sure is to ask for a quote reflecting the change.

How to Get the Right Non-Driver on Car Insurance Coverage

Getting the right non driver on car insurance is straightforward once you know your needs. The first step is to assess your situation: do you need a non-owner policy for yourself, or do you need to list a household member on your existing policy?

Custom quotes are crucial, as generic ones don’t tell the whole story. As an agency with access to over 40 carriers, we can shop around to find the best fit for you. More info about getting insurance without a car

Obtaining a Non-Owner Insurance Policy

Getting a non-owner car insurance policy is simpler than getting standard auto insurance. The easiest way is to work with an experienced agent. We’ll need your basic information: name, address, date of birth, driver’s license number, and driving history.

We’ll also discuss your driving habits—how often you rent, borrow, or use car-sharing services—to recommend the right coverage limits. With this information, we can pull quotes from multiple carriers. While rates vary, we aim to find competitive options that provide solid protection. For example, if you’re in Florida, we can help you find a policy that fits your needs. Get a quote for auto insurance in Florida

Adding or Excluding a Driver from Your Policy

For vehicle owners, managing who is on your policy is key. This involves either adding a regular driver or formally excluding someone.

To add a driver, simply provide us with their name, date of birth, driver’s license number, and driving history. You can easily update your policy with us online or by phone.

A named driver exclusion formally states that a specific household member is not covered to drive your car. This is a serious step, often considered if a household member has a poor driving record or has their own separate insurance and never drives your vehicle.

To exclude a driver, some insurers may require a signed non-driver statement or proof of their separate insurance. Transparency with your provider is essential to avoid denied claims later. It’s always better to clarify your household situation upfront.

Frequently Asked Questions about Non-Driver Insurance

Here are answers to some common questions about non driver on car insurance.

What is the difference between non-owner insurance and rental car insurance?

These two coverages are often confused but serve different purposes.

-

Non-owner car insurance provides liability protection. It covers bodily injury and property damage you cause to others when driving a car you don’t own. It does not cover damage to the car you are driving. It acts as secondary coverage, kicking in after the car’s primary insurance is used up.

-

Rental car insurance, often sold as a Collision Damage Waiver (CDW), covers physical damage to the rental vehicle itself. It does not typically provide liability coverage.

In short: Non-owner insurance protects others from you; a CDW protects the rental car. For frequent renters, an annual non-owner policy is often more cost-effective than buying daily rental insurance.

Can non-owner insurance help me maintain continuous coverage?

Yes. Insurance companies dislike gaps in coverage history, which can lead to higher rates later. A non-owner car insurance policy prevents these gaps by showing you’ve maintained continuous liability coverage, even without owning a car. This can result in better rates when you eventually buy a vehicle.

When might I NOT need non-owner car insurance?

This coverage isn’t for everyone. You likely don’t need it if:

- You rarely drive. If you only borrow a car once or twice a year, the owner’s permissive use clause may be sufficient.

- You’re listed on a household member’s policy. If you live with someone and are listed as a driver on their policy, you are already covered.

- You only drive a company car for business. Your employer’s commercial auto policy should cover you for business use. More info about business auto insurance

- You own a car and have your own policy. A standard auto policy typically extends liability coverage when you occasionally drive other cars.

Conclusion

Getting non driver on car insurance right is about protecting yourself from financial risk without overpaying. Whether you need non-owner insurance for driving borrowed cars or need to manage household members on your policy, understanding the difference is key.

As we’ve covered, non-owner car insurance provides liability protection when you drive a car you don’t own, helping maintain your insurance history. We’ve also clarified that any licensed driver with regular access to your car in your household must be listed on your policy to avoid denied claims.

The good news is you don’t have to steer this alone. At Select Insurance Group, our 30+ years of experience and access to over 40 carriers mean we can find the right coverage for your unique situation, whether you’re in Florida, the Carolinas, or beyond.

Our experienced agents provide straightforward, honest guidance to find a policy that makes sense for you. We’re here to translate your needs into the right protection.

Ready to get the right coverage? Whether you need a non-owner car insurance policy or want to ensure your household drivers are properly listed, we can help. Find the right North Carolina auto insurance policy for your needs today! Reach out to us directly with any questions about your specific situation.