Why Finding the Right Car Insurance in Charlotte Matters

Car insurance Charlotte NC is more than a legal requirement—it’s essential financial protection for driving in one of the Southeast’s fastest-growing cities.

Quick Answer for Charlotte Drivers:

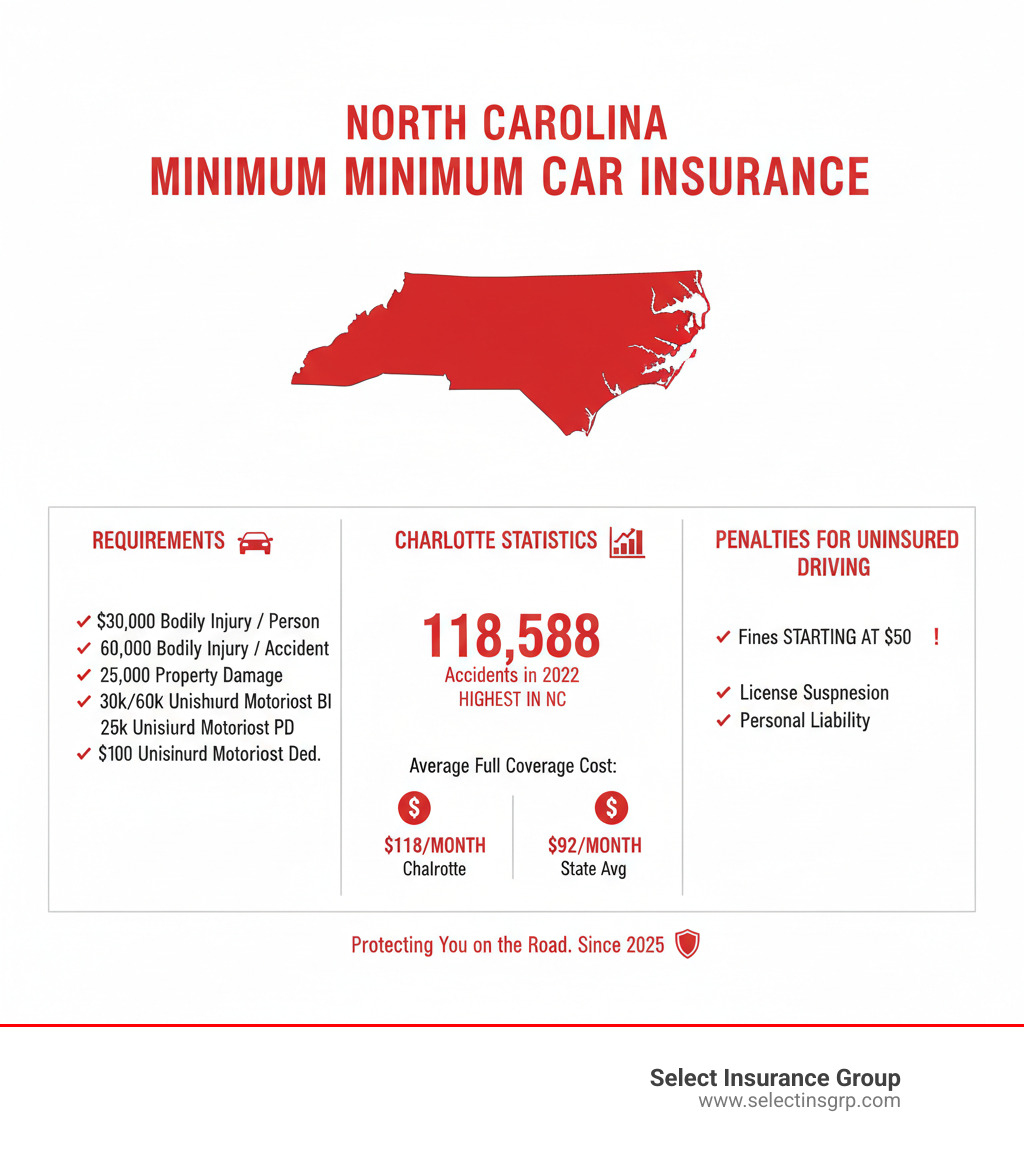

- State Minimums: $30k/$60k bodily injury liability, $25k property damage, and $30k/$60k uninsured motorist coverage.

- Average Cost: Roughly $118 per month for full coverage, which is higher than the NC state average.

- Key Rate Factors: Your driving record, ZIP code, age, and vehicle type are the biggest influencers.

- Uninsured Penalties: Fines, license suspension, and full personal liability for all damages.

Charlotte is North Carolina’s most populous city, and with that growth comes more traffic. The city recorded 118,588 accidents in 2022, the highest in the state. The right auto insurance provides crucial peace of mind on busy roads like I-485 and in neighborhoods across the Queen City.

Finding affordable, comprehensive car insurance in Charlotte is possible. Understanding your options is the first step to securing protection that fits your needs and budget.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, I’ve helped drivers in Charlotte and across the Southeast find the right car insurance Charlotte NC solutions. Our team shops over 20 carriers to ensure our clients get competitive rates without sacrificing quality coverage.

Car insurance Charlotte NC helpful reading:

- NC auto insurance requirements

- NC auto insurance companies

- where in north carolina is auto insurance the least expensive

Understanding North Carolina’s Legal Requirements

Before driving in Charlotte, it’s crucial to understand North Carolina’s car insurance requirements. These laws are your financial safety net, ensuring everyone on the road has a baseline level of protection.

North Carolina requires four specific coverages in your car insurance Charlotte NC policy. Bodily Injury Liability covers costs for others if you’re at fault, while Property Damage Liability pays for damage to their property. Uniquely, NC also mandates Uninsured Motorist Bodily Injury and Uninsured Motorist Property Damage coverage to protect you from drivers who break the law by not having insurance.

These are minimums and may not fully protect your assets in a serious accident. For a deeper dive, see our guide: More info about NC auto insurance.

Minimum Coverage Mandates in NC

Here are the specific minimums North Carolina requires:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident.

- Property Damage Liability: $25,000 per accident.

- Uninsured Motorist Bodily Injury: $30,000 per person / $60,000 per accident.

- Uninsured Motorist Property Damage: $25,000 with a $100 deductible.

Important Update: Starting July 1, 2025, these minimums will increase. Bodily Injury Liability will rise to $50,000/$100,000, and Property Damage Liability will jump to $50,000. This change reflects the rising costs of accidents, and we are already helping clients prepare.

Consequences of Driving Uninsured in Charlotte

Driving without insurance in Charlotte is a costly mistake with severe consequences.

A first offense brings fines starting at $50, but the real penalties are license and vehicle registration suspension. The biggest risk, however, is personal liability for all damages. As an at-fault state, if you cause an accident, you are responsible for all costs. Without insurance, this could lead to lawsuits, wage garnishment, and financial ruin.

North Carolina also follows a strict pure contributory negligence rule. This means if you are found even 1% at fault for an accident, you cannot collect any money from the other driver. This rule makes having your own solid coverage essential.

Finally, a lapse in coverage will lead to significantly higher premiums in the future, as insurers will view you as a high-risk driver. The cost of minimum insurance is a fraction of the potential cost of driving uninsured.

Decoding Your Coverage Options Beyond the Minimum

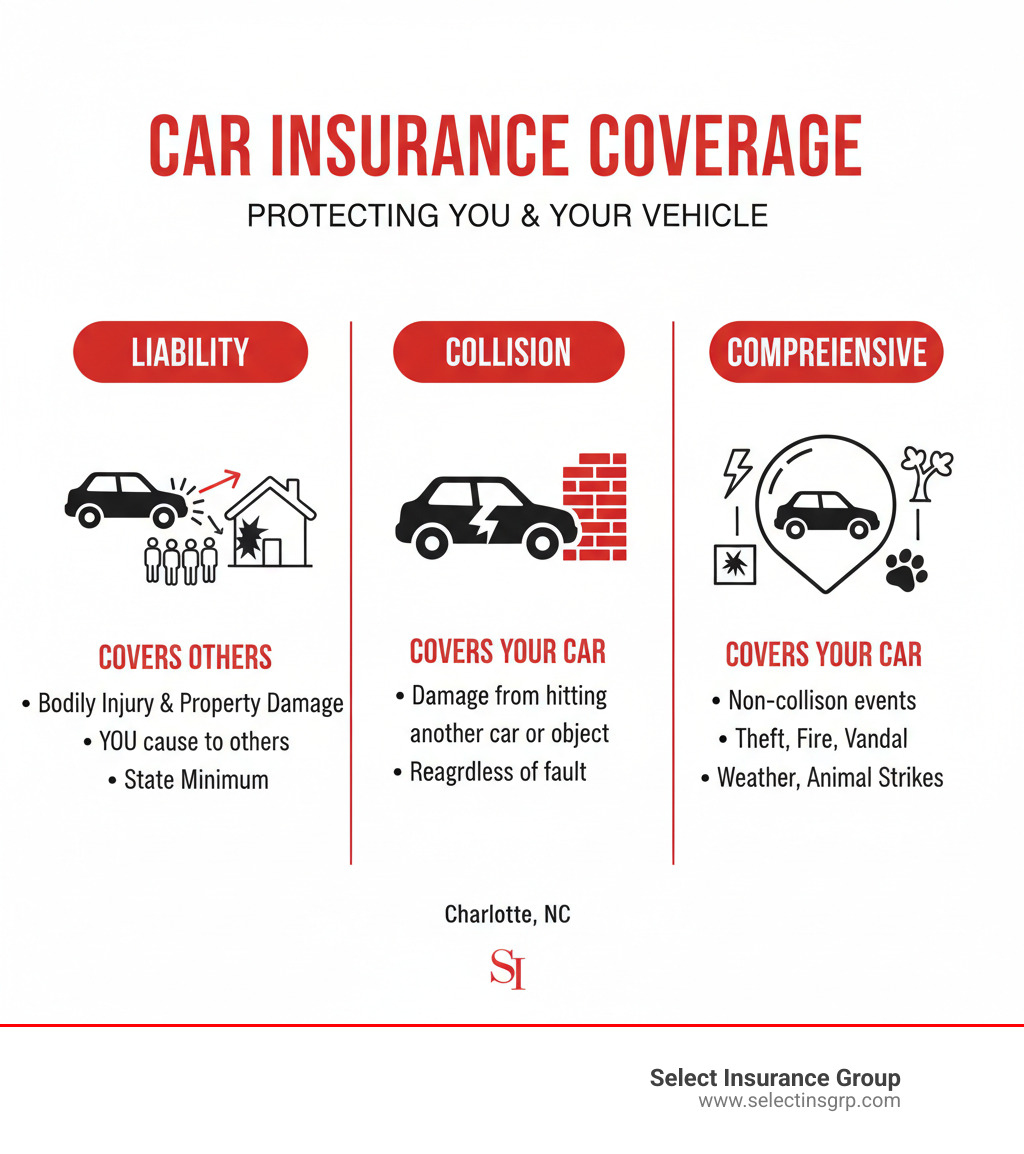

State minimums protect others, but what about protecting yourself and your vehicle? A serious accident can easily exceed minimum limits, making additional coverage crucial for true peace of mind on Charlotte’s roads.

Beyond mandatory liability, consider these key options. Collision coverage pays for damage to your car from a crash, while Comprehensive coverage protects it from theft, vandalism, weather, and animal strikes. Together with liability, these form what is often called “full coverage.”

When selecting these, you’ll choose a deductible—the amount you pay before insurance kicks in. A higher deductible lowers your premium, but ensure it’s an amount you can comfortably afford. We work with many NC auto insurance companies to find the right balance for you.

Protecting Your Own Vehicle

Your car is a major investment. To protect it, you need more than just liability insurance.

- Collision Insurance: This is invaluable, paying to repair or replace your vehicle if it’s damaged in a crash with another car or object, regardless of fault.

- Comprehensive Insurance: This protects you from nearly everything else. In Charlotte, it’s vital for risks like theft, vandalism, hail, flood damage, and common animal collisions.

Without these coverages, you would pay for all repairs or replacement costs out of pocket. For most drivers, especially those with newer or financed vehicles, they are essential.

Additional Protection for Peace of Mind

Several other options can significantly boost your financial safety net.

- Medical Payments (MedPay): This covers medical expenses for you and your passengers after an accident, regardless of fault. It pays out quickly for things like ambulance fees and hospital visits, and can cover your health insurance deductibles.

- Uninsured/Underinsured Motorist (UM/UIM): While basic UM is required, higher limits are critical. UM/UIM protects you when an at-fault driver has no insurance or not enough to cover your medical bills and vehicle damage.

- Umbrella Policies: For those with significant assets like a home or savings, an umbrella policy provides an extra layer of liability protection (typically $1 million or more) after your standard auto limits are exhausted. It’s an affordable way to shield yourself from large lawsuits.

Finding the right mix of coverages for your car insurance Charlotte NC policy is our specialty. We shop over 40 carriers to find protection that fits your needs and budget.

What Determines Your Car Insurance Rates in Charlotte, NC?

Auto insurance rates are highly personalized, calculated using a variety of factors to assess your risk as a driver. Understanding these factors can help you make smarter choices and potentially lower your premium.

The main things that influence your car insurance Charlotte NC rates include:

- Driving Record: This is often the biggest factor. A clean record with no accidents or tickets leads to lower rates.

- Vehicle Type: The make, model, and safety features of your car matter. Expensive or high-theft vehicles cost more to insure, while cars with advanced safety features may earn discounts.

- Age and Experience: Younger, less experienced drivers typically pay the highest premiums. Rates tend to decrease with age and experience.

- Annual Mileage: The more you drive, the higher the risk of an accident, which can increase your rate.

- Credit History: In North Carolina, insurers may use a credit-based insurance score. A good credit history can often lead to lower premiums.

- Coverage and Deductibles: Higher coverage limits and lower deductibles will increase your premium. Finding the right balance is key.

Charlotte’s busy environment, as noted by the Charlotte Area Chamber, makes all these factors particularly important.

Local Factors for Car Insurance in Charlotte, NC

Where you live and drive within Charlotte also significantly impacts your rates.

- ZIP Code Variations: Rates can vary between neighborhoods based on local risk factors like traffic density and crime rates.

- Population Density and Accident Frequency: As a growing city, Charlotte has more cars on the road, leading to a higher chance of accidents. With 118,588 incidents in 2022, Charlotte’s high accident rate contributes to higher insurance costs compared to the state average.

- Urban vs. Suburban Rates: Densely populated urban areas like Uptown typically have higher rates than quieter suburban parts of Mecklenburg County due to increased traffic and theft risk.

While auto insurance in North Carolina can be less expensive than in other states, Charlotte’s specific dynamics require custom advice.

Personal Factors You Can Control

The good news is that you can actively influence many factors to achieve better rates.

- Maintain a Clean Driving Record: Avoiding tickets and at-fault accidents is the most effective way to keep your premiums low.

- Choose a Safer Vehicle: Cars with high safety ratings, anti-theft features, and lower repair costs often qualify for cheaper insurance.

- Consider Usage-Based Insurance (Telematics): Many insurers offer programs that track your driving habits via a smartphone app or device. Safe driving behaviors like smooth braking and reasonable speeds can earn you significant discounts.

How to Save on Car Insurance Charlotte NC

You don’t have to settle for high premiums on your car insurance Charlotte NC. There are many practical strategies to save money without sacrificing the protection you need.

Comparison shopping is essential, as rates can vary by hundreds of dollars between companies for the same coverage. Beyond that, take advantage of available discounts, bundle your policies, and consider telematics programs that reward safe driving.

At Select Insurance Group, we do the comparison shopping for you, working with over 40 carriers to find you competitive rates and quality coverage.

Common Discounts for Charlotte Drivers

Most insurers offer a long list of discounts. Ask your agent if you qualify for these common savings opportunities:

- Multi-Policy Discount: Often the biggest saver, earned by bundling auto with home, renters, or motorcycle insurance.

- Good Student Discount: For full-time students, typically under 25, who maintain a B average or better.

- Safe Driver Discount: Awarded for maintaining a clean driving record, usually for three to five years.

- Vehicle Safety Features: For cars with anti-lock brakes, airbags, anti-theft systems, and other safety tech.

- Pay-in-Full & Automatic Payments: Discounts for paying your premium upfront or setting up automatic withdrawals.

- Defensive Driving Course: Often available for drivers over 55 who complete an approved course.

We make it our business to find every discount you’ve earned.

The Power of Bundling

Bundling your insurance policies is one of the easiest and most effective ways to save.

Combining your auto and North Carolina Home Insurance with the same provider typically results in a significant multi-policy discount on both. The same applies when you bundle auto with renters insurance or North Carolina Motorcycle Insurance.

If you have multiple vehicles, a multi-car policy will almost always save you money compared to insuring them separately.

Beyond the savings, bundling streamlines your policy management. You get one point of contact, one renewal date, and a simplified billing process. It’s a win-win: you save money and reduce hassle, all while having a single trusted advisor looking out for your needs.

Finding and Comparing Car Insurance Quotes in Charlotte

When you’re ready to secure your car insurance Charlotte NC, the process of comparing quotes doesn’t have to be difficult.

You can get quotes from online tools or direct insurers, but these limit you to a single company’s offerings. A captive agent also works for only one insurer.

In contrast, independent insurance agents like us at Select Insurance Group work with multiple carriers. We shop the market on your behalf to find the best combination of coverage and price.

To get started, have this information ready: your personal and driver’s license details, vehicle information (VIN, mileage), driving history, and desired coverage levels for all drivers in your household.

The Role of an Independent Insurance Agent

As independent agents, we work for you, not the insurance companies. This is our key advantage in finding your ideal car insurance Charlotte NC.

- Access to Multiple Carriers: We compare quotes from over 40 insurance companies to find you the best value.

- Personalized Advice: We take the time to understand your unique situation and recommend coverage that truly fits your life.

- Custom Coverage: We help you build the right policy, ensuring you have the protection you need without paying for extras you don’t.

- Local Expertise: We understand the specific risks of driving in Charlotte and the nuances of North Carolina’s insurance laws.

Think of us as your personal insurance advisor. If you’re looking for an insurance agency in Charlotte that puts your interests first, we’re here to help.

Getting the Best Quote for Car Insurance in Charlotte, NC

Getting the best quote is about finding true value, not just the lowest price.

First, always compare apples-to-apples coverage. Ensure that every quote you review has identical liability limits, deductibles, and endorsements. A cheap policy might have dangerously low limits.

Next, review policy details beyond the price. Does it include roadside assistance or rental car reimbursement? Understanding the fine print prevents surprises later.

Finally, ask questions. If anything is unclear, speak up. We are here to explain everything in plain language so you can feel confident in your decision. When you’re ready, we’ll walk you through finalizing your policy step-by-step, ensuring a smooth and straightforward process.

Our mission is to simplify insurance and empower you with expert guidance. Ready to get started? Get a Quote today and let’s find the right coverage together.

Frequently Asked Questions about Charlotte Auto Insurance

We’ve helped Charlotte drivers for decades, and a few questions always come up. Here are answers to the most common concerns about car insurance Charlotte NC.

What is the average cost of car insurance in Charlotte?

On average, full coverage in Charlotte costs around $118 per month, while liability-only is about $73 per month. This is higher than the North Carolina state average (around $92 and $59, respectively). The higher cost is due to Charlotte’s population density and high accident frequency—the city had the most accidents in the state in 2022. However, your actual rate will depend on your personal profile, so it’s crucial to compare quotes.

Is North Carolina an “at-fault” state?

Yes, North Carolina is an “at-fault” state, meaning the driver who causes an accident is financially responsible for the damages. Our state also uses a strict “pure contributory negligence” rule. This rule can prevent you from collecting any damages from the other driver if you are found to be even 1% at fault for the accident, making robust personal coverage essential.

How much car insurance do I really need in Charlotte?

You almost certainly need more than the state minimum. While minimums keep you legal, they likely won’t cover all costs in a serious accident. If you have a loan or lease, your lender will require full coverage (collision and comprehensive). To protect your assets (home, savings), we typically recommend higher liability limits, such as $100,000/$300,000 for bodily injury and $100,000 for property damage. Adding robust UM/UIM and Medical Payments coverage provides an even stronger safety net.

Your Guide to the Best Coverage in the Queen City

Navigating the busy streets of our beloved Queen City requires smart, solid car insurance Charlotte NC. We’ve covered a lot, from legal requirements to money-saving tips.

Here’s a quick recap:

- Exceed Minimums: North Carolina’s legal requirements are just a starting point.

- Protect Yourself: Consider full coverage (collision and comprehensive) and higher liability limits to protect your vehicle and your assets.

- Find Savings: Always ask about discounts and bundle your policies to lower your premiums.

- Get Expert Guidance: Finding the right balance between price and protection can be complex, but you don’t have to do it alone.

At Select Insurance Group, we put over 30 years of experience to work for you. We shop over 40 carriers to find competitive rates and the superior service you deserve. Our goal is to give you the peace of mind to enjoy everything Charlotte has to offer, knowing you’re well-protected.

Ready to secure the right car insurance Charlotte NC for your needs? Let us find the perfect policy for your life and budget. Find the right North Carolina auto insurance policy for your needs today!