Why You Need Insurance Even Without a Car

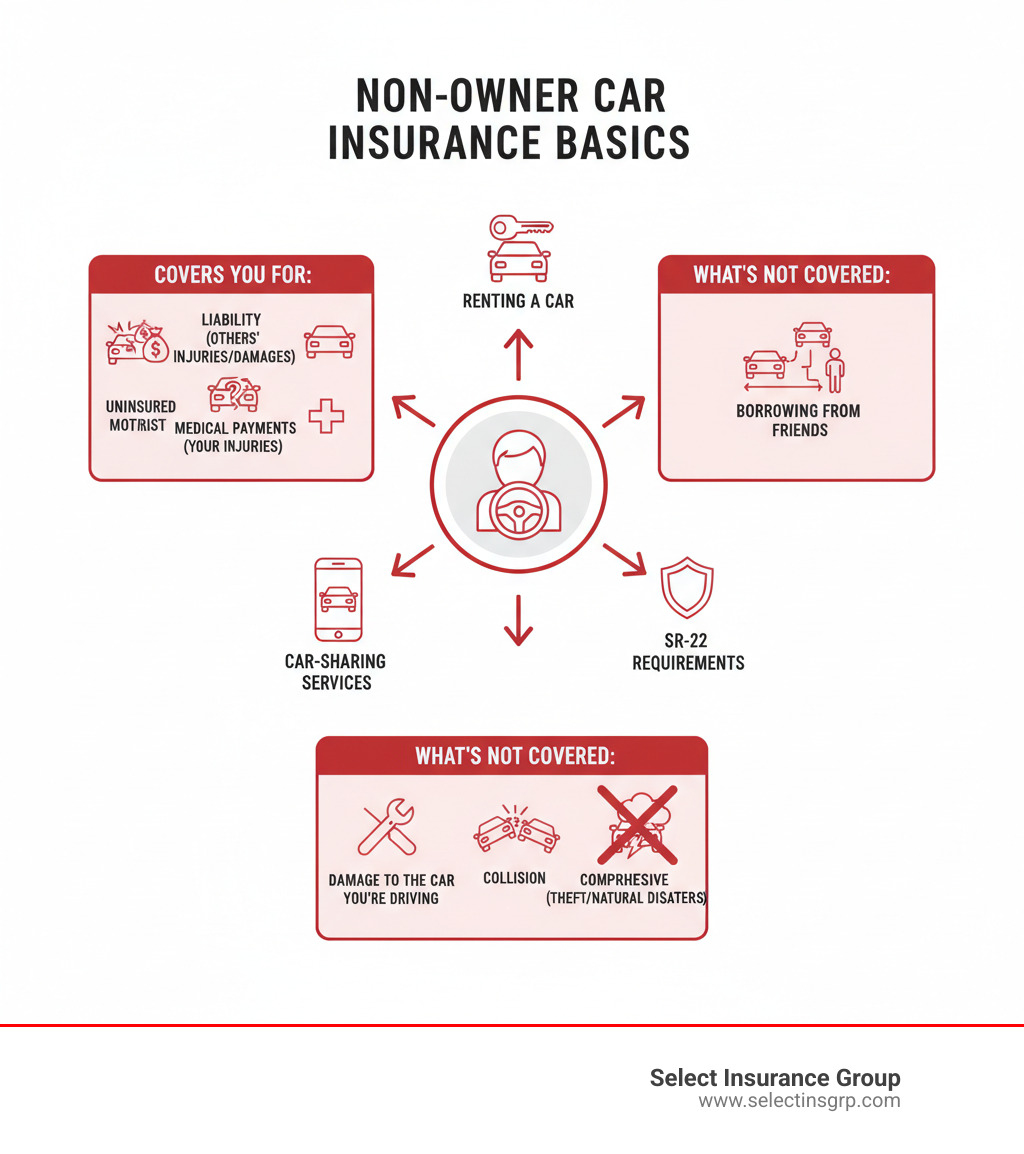

The ability to buy insurance without a car is not just possible—it’s often a financial necessity. For those who drive regularly but don’t own a vehicle, non-owner car insurance provides essential liability coverage. It protects you when you rent cars, borrow from friends, or use car-sharing services, helping ensure you aren’t personally responsible for costly damages if you cause an accident.

Here’s what you need to know about buying insurance without a car:

- What it is: Non-owner car insurance provides liability coverage for drivers who don’t own a vehicle

- Who needs it: Frequent car renters, car-sharing users, and drivers maintaining continuous coverage

- What it covers: Bodily injury liability, property damage liability, and often uninsured motorist coverage

- What it costs: Typically $200-$500 per year—much less than standard auto insurance

- Where to get it: Through most major insurance companies, though you may need to contact an agent directly

Nearly every state requires drivers to carry liability coverage. If you borrow a friend’s car and cause an accident that exceeds their policy limits, you could be personally responsible for the remaining costs. Non-owner insurance fills this gap, acting as secondary coverage to protect you when the car owner’s policy isn’t enough.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over 30 years of collective industry expertise and access to more than 40 insurance carriers, we’ve helped thousands of drivers across the Southeast buy insurance without a car through non-owner policies, securing affordable protection for their unique situations.

Buy insurance without a car terms made easy:

- getting liability insurance without a car

- getting sr22 insurance without a car

- is there such thing as a non owner auto insurance

Understanding Non-Owner Car Insurance

Non-owner car insurance is a specialized policy for people who drive but don’t own a vehicle. Instead of insuring a car, you’re insuring yourself. When you buy insurance without a car, you get liability coverage that travels with you, protecting you financially when you drive a rental, a friend’s car, or a car-share vehicle.

Crucially, non-owner insurance works as secondary coverage. If you borrow a friend’s car and cause an accident, their insurance pays first. But if the damages exceed their policy limits—say, $35,000 in medical bills on a $25,000 policy—your non-owner policy would cover the remaining $10,000. It protects you from financial losses when the car owner’s policy isn’t enough.

What Non-Owner Insurance Covers

When you buy insurance without a car, you’re primarily getting liability protection. This ensures you won’t face financial ruin if you cause an accident while driving someone else’s vehicle.

Bodily injury liability pays for medical expenses, lost wages, and pain and suffering for anyone you injure in an accident. It protects your personal assets from lawsuits.

Property damage liability pays for repairs or replacement if you damage someone’s car or property. Without it, you’d pay out of pocket.

Uninsured and underinsured motorist coverage is a crucial addition. If a driver with little or no insurance hits you, this coverage helps pay for your medical bills and lost wages. It doesn’t cover the car you’re driving, but it protects you.

Depending on your state, you may also add Medical Payments (MedPay) or Personal Injury Protection (PIP). These cover your own medical expenses after an accident, regardless of who is at fault, filling a key gap in basic non-owner policies.

For more detailed information about how these policies work, check out more info about non-owner auto insurance.

What Non-Owner Insurance Does Not Cover

Understanding what a non-owner policy doesn’t cover is critical to avoid surprises.

The biggest limitation is that it doesn’t cover damage to the vehicle you’re driving. Collision coverage (for at-fault accidents) and comprehensive coverage (for theft, vandalism, etc.) are not included. The car owner’s policy is responsible for these risks.

When renting a car, this gap is important. Your non-owner policy provides liability, but it won’t pay to repair the rental car itself. For that, you’ll need the rental company’s Collision Damage Waiver (CDW) or coverage from your credit card.

Your own injuries are not covered unless you add Medical Payments or Personal Injury Protection to your policy. A basic policy focuses on your liability to others.

Finally, if you live with someone who owns a car and you drive it regularly, you can’t simply buy insurance without a car. You must be listed as a driver on the car owner’s primary policy instead.

Non-Owner vs. Permissive Use Insurance

Understanding the difference between non-owner insurance and permissive use clarifies how you’re protected.

Permissive use is when a car owner’s insurance extends to you when you borrow their vehicle. Their policy is primary and covers damages first. However, this can be risky if their liability limits are low, leaving you exposed to excess costs.

Non-owner car insurance is your personal liability policy that acts as secondary coverage. It kicks in after the car owner’s policy is exhausted, giving you control over your own protection regardless of whose car you drive.

| Feature | Non-Owner Insurance (Your Policy) | Permissive Use (Car Owner’s Policy) |

|---|---|---|

| Policyholder | You (the driver) | The car owner |

| Coverage Focus | Your liability when driving non-owned vehicles | The car and its owner, extended to permitted drivers |

| Primary/Secondary | Typically secondary (kicks in after owner’s policy or if it’s insufficient) | Primary (covers damages first) |

| Vehicle Covered | Any non-owned vehicle you drive (rentals, borrowed cars, car-shares) | The specific vehicle owned by the policyholder |

| Coverage Limits | Determined by your non-owner policy | Determined by the car owner’s policy |

| Use Case Scenarios | Frequent renters, car-sharing, borrowing various cars, SR-22/FR-44 | Occasional borrowing of a friend’s or family member’s car |

The key difference is control. Permissive use makes you dependent on someone else’s policy. A non-owner policy ensures you have adequate liability protection no matter whose car you’re driving.

Who Needs a Non-Owner Policy?

If you regularly drive vehicles you don’t own, you’re taking on financial risk. A non-owner policy protects you from that risk. When you borrow a car, the owner’s insurance is primary, but it may not be enough to cover a serious accident. Your non-owner policy steps in to cover the gap, protecting your assets and your relationships with those who lend you their vehicles.

Scenarios Where It’s a Smart Choice

Here are real-life situations where deciding to buy insurance without a car makes financial sense.

Frequent car rentals are a top reason. If you rent cars often, a non-owner policy is usually cheaper than buying the rental company’s liability insurance every time. An annual policy costing $200-$500 can save you money over daily charges of $10-$30.

Car-sharing services like Zipcar and Turo include insurance, but the liability limits might be low. A non-owner policy supplements this coverage for greater peace of mind.

Borrowing cars from friends or family is another common case. When you borrow a car, an accident could raise your friend’s rates or exceed their coverage. Your non-owner policy acts as a backup, protecting both of you from financial strain.

Maintaining continuous coverage is important to insurers. A gap in your insurance history can lead to higher premiums later. A non-owner policy keeps your coverage continuous, which insurers see as less risky, potentially saving you money when you buy a car in the future.

When you need to buy insurance without a car for legal reasons

Sometimes, non-owner insurance is a legal requirement, not just a smart choice.

SR-22 requirements are the most common reason. An SR-22 is a certificate your insurer files with the state to prove you have liability coverage, often required after a DUI, reckless driving, or other serious violation. A non-owner SR-22 policy fulfills this requirement if you don’t own a car. Some states, like Florida and Virginia, use a similar FR-44 filing that requires higher limits.

Court-ordered insurance may also mandate that you carry auto insurance as part of a sentence, regardless of vehicle ownership. A non-owner policy satisfies this legal requirement.

Reinstating a driver’s license after suspension often requires proof of financial responsibility. A non-owner policy provides the necessary documentation for the DMV.

These situations can be stressful. Our guide to getting SR22 insurance without a car walks you through everything you need to know.

When You Might Not Need It

Non-owner insurance isn’t for everyone. Here’s when you might not need it.

Infrequent driving is the first consideration. If you only drive a non-owned car once or twice a year, the annual cost may not be justified. Relying on permissive use or temporary rental insurance might be more practical.

Living with a car owner changes the rules. If you live with a car owner and have regular access to their vehicle, you must be listed on their policy. A non-owner policy is not appropriate in this case and could lead to a denied claim.

Company car usage is another exception. If your employer provides a company car, their commercial auto policy should cover you. Confirm the specifics with your employer.

Sufficient permissive use might be enough if you only borrow from someone with high liability limits. However, you remain personally liable for any damages that exceed their coverage.

How to Buy Insurance Without a Car

The process to buy insurance without a car is simpler than you might think. Since there’s no vehicle to insure, the focus is entirely on you as a driver—your record, habits, and coverage needs.

The Process of Getting a Quote

Most insurers don’t offer non-owner policies through online quote tools, so you’ll need to speak with an agent. An independent agent like those at Select Insurance Group can shop multiple carriers to find the best fit.

To get a quote, you’ll need to provide your driver’s license number and discuss your driving habits and driving record. We’ll help you compare coverage limits to find the right balance of protection and cost.

Once we have this information, we can provide quotes from our network of over 40 carriers, making the process straightforward and pressure-free. When you’re ready, get a personalized quote today and we’ll guide you through the steps.

How to buy insurance without a car and understand the cost

Non-owner car insurance is highly affordable, typically costing $200 to $500 per year. It’s cheaper because it only covers your liability as a driver, not a physical vehicle, and assumes you drive less frequently than a car owner.

Your final cost will depend on your driving record, location, and chosen coverage amount. Needing an SR-22 or FR-44 filing will increase the premium, but it remains a cost-effective way to get targeted protection that keeps you legal and financially secure.

State-Specific Programs and Resources

Some states offer special programs to help drivers access affordable coverage. For example, California’s Low Cost Auto Insurance Program helps income-eligible drivers with good records get liability coverage at reduced rates. You can learn more at California’s Low Cost Auto Insurance Program.

Other states have similar initiatives or plans for specific demographics. All states have financial responsibility laws that require drivers to prove they can cover damages from an accident. A non-owner policy is an accepted way to meet these requirements, especially for SR-22 or FR-44 filings. We can help you steer your state’s specific laws to find the right solution.

Frequently Asked Questions about Non-Owner Insurance

Here are answers to common questions we hear from clients looking to buy insurance without a car.

Does non-owner insurance cover rental cars?

Yes, your non-owner insurance provides liability coverage when you drive a rental car, covering injuries or damage you cause to others. However, it does not cover damage to the rental car itself.

For that, you have two main options: purchase the Collision Damage Waiver (CDW) from the rental company or use coverage provided by your credit card. Always check with your credit card company before renting to see what benefits you have. A non-owner policy handles your liability, but you need a separate plan to protect the rental vehicle.

Is non-owner insurance cheaper than a standard policy?

Yes, non-owner insurance is significantly cheaper than a standard policy, typically costing $200 to $500 per year. The lower cost is because the policy has fewer risk factors. It doesn’t cover a physical vehicle against damage or theft, and insurers assume non-owners drive less frequently. You get essential liability protection when you buy insurance without a car without paying for expensive collision or comprehensive coverage.

Can I get a non-owner policy if I live with the car owner?

The answer is usually no. If you live with a car owner, insurers assume you have regular access to their vehicle and will require you to be listed as a driver on their primary policy. Attempting to use a non-owner policy in this situation could lead to a denied claim in an accident, as it’s not designed for drivers with regular access to a specific household vehicle. Adding yourself to the owner’s policy is the correct way to ensure proper coverage for everyone. Non-owner policies are for drivers who use various non-owned cars, not one that is regularly available at home.

Conclusion

Driving without owning a car doesn’t mean driving without protection. As we’ve covered, a non-owner policy is an essential tool for frequent renters, car-sharing users, and anyone who needs to buy insurance without a car for legal reasons. It provides crucial liability coverage, protects you from lawsuits, and keeps your insurance record active—all for a fraction of the cost of a standard policy.

For an average of $200 to $500 per year, you gain peace of mind knowing you’re not personally on the hook for damages if an accident occurs.

At Select Insurance Group, we specialize in finding the right coverage for every driver. With over 30 years of experience and access to more than 40 carriers across Florida, the Carolinas, Virginia, and Georgia, we shop the market to find the perfect non-owner policy for your budget and needs. We’re here to cut through the confusion and help you drive with confidence.

Ready to get protected? Don’t wait for an accident to happen. Whether you’re in North Carolina or anywhere else we serve, we’re ready to help you find the perfect policy.

Find the right North Carolina auto insurance policy for your needs